Summary

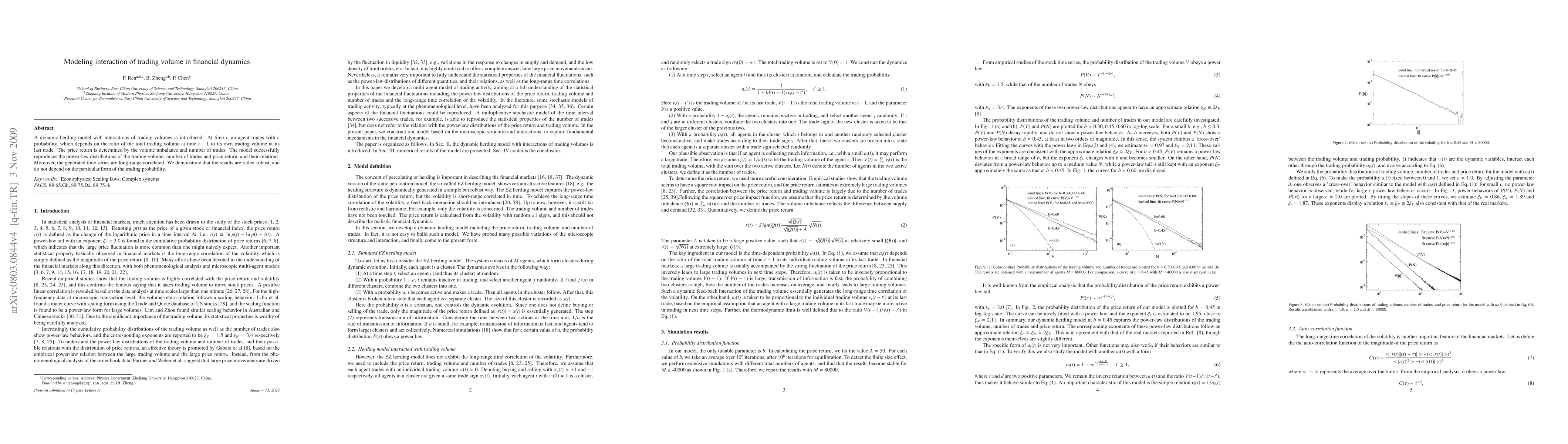

A dynamic herding model with interactions of trading volumes is introduced. At time $t$, an agent trades with a probability, which depends on the ratio of the total trading volume at time $t-1$ to its own trading volume at its last trade. The price return is determined by the volume imbalance and number of trades. The model successfully reproduces the power-law distributions of the trading volume, number of trades and price return, and their relations. Moreover, the generated time series are long-range correlated. We demonstrate that the results are rather robust, and do not depend on the particular form of the trading probability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)