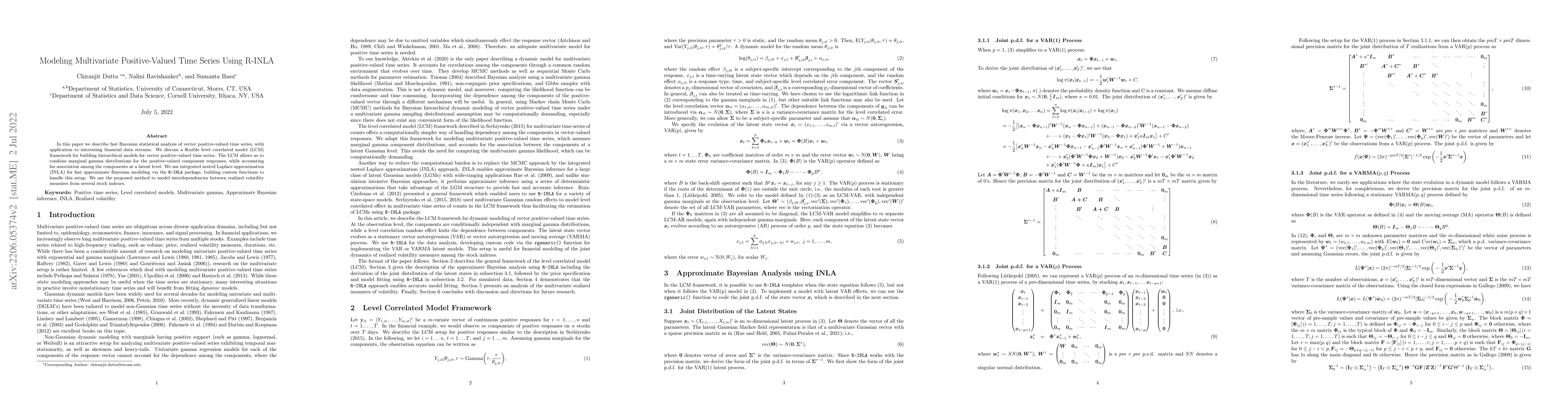

Summary

In this paper we describe fast Bayesian statistical analysis of vector positive-valued time series, with application to interesting financial data streams. We discuss a flexible level correlated model (LCM) framework for building hierarchical models for vector positive-valued time series. The LCM allows us to combine marginal gamma distributions for the positive-valued component responses, while accounting for association among the components at a latent level. We use integrated nested Laplace approximation (INLA) for fast approximate Bayesian modeling via the R-INLA package, building custom functions to handle this setup. We use the proposed method to model interdependencies between realized volatility measures from several stock indexes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Inference for Multivariate Spatial Models with R-INLA

Håvard Rue, Michela Cameletti, Virgilio Gómez-Rubio et al.

Interval-Valued Time Series Classification Using $D_K$-Distance

Wan Tian, Zhongfeng Qin

| Title | Authors | Year | Actions |

|---|

Comments (0)