Authors

Summary

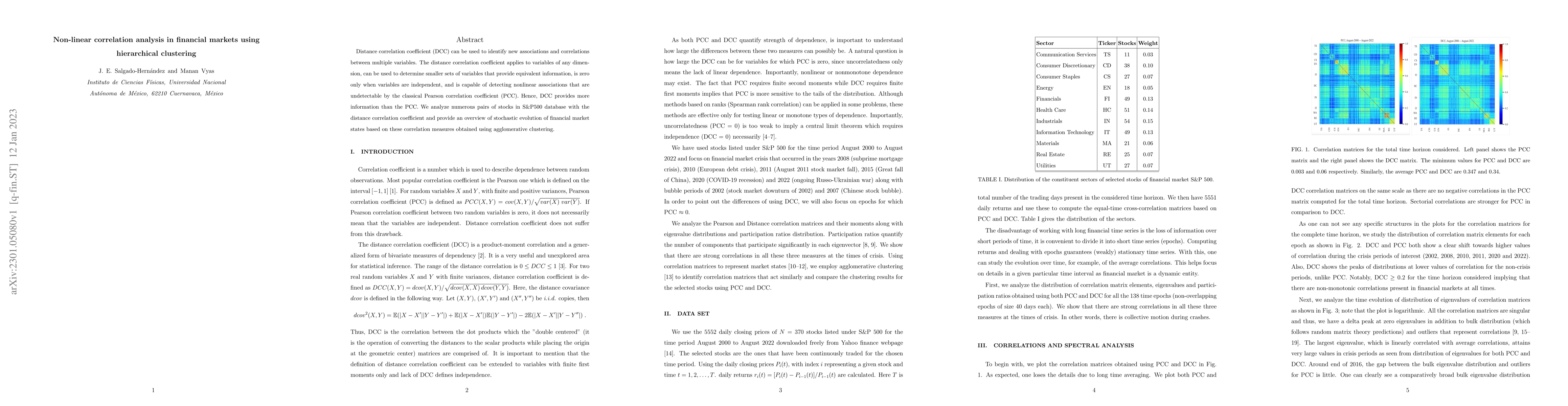

Distance correlation coefficient (DCC) can be used to identify new associations and correlations between multiple variables. The distance correlation coefficient applies to variables of any dimension, can be used to determine smaller sets of variables that provide equivalent information, is zero only when variables are independent, and is capable of detecting nonlinear associations that are undetectable by the classical Pearson correlation coefficient (PCC). Hence, DCC provides more information than the PCC. We analyze numerous pairs of stocks in S\&P500 database with the distance correlation coefficient and provide an overview of stochastic evolution of financial market states based on these correlation measures obtained using agglomerative clustering.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)