Authors

Summary

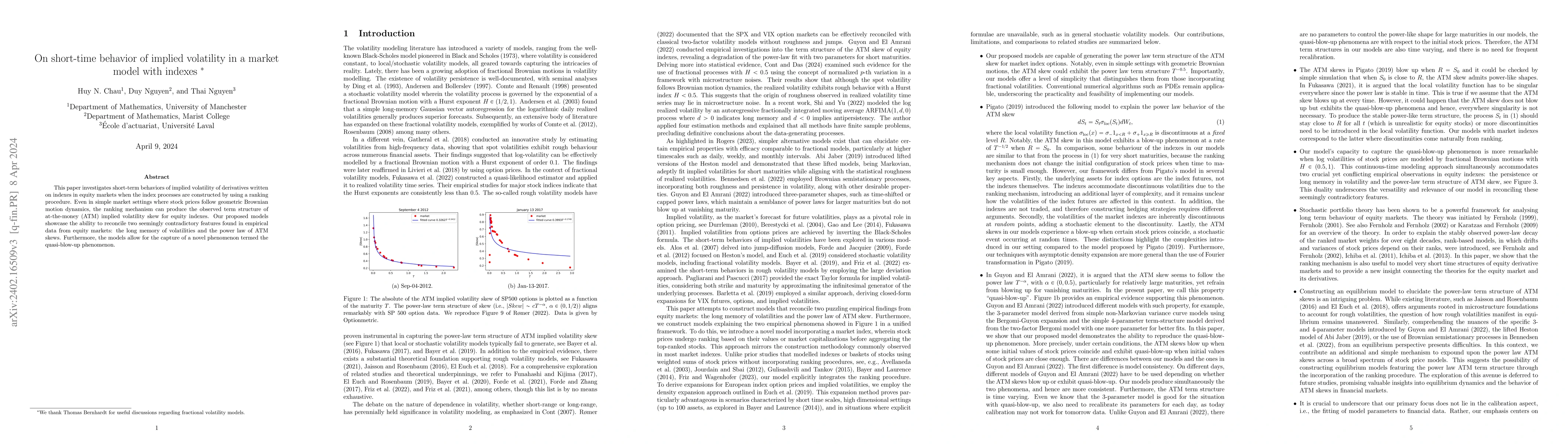

This paper investigates short-term behaviors of implied volatility of derivatives written on indexes in equity markets when the index processes are constructed by using a ranking procedure. Even in simple market settings where stock prices follow geometric Brownian motion dynamics, the ranking mechanism can produce the observed term structure of at-the-money (ATM) implied volatility skew for equity indexes. Our proposed models showcase the ability to reconcile two seemingly contradictory features found in empirical data from equity markets: the long memory of volatilities and the power law of ATM skews. Furthermore, the models allow for the capture of a novel phenomenon termed the quasi-blow-up phenomenon.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShort-time behavior of the At-The-Money implied volatility for the jump-diffusion stochastic volatility Bachelier model

Elisa Alòs, Josep Vives, Òscar Burés

Integrating the implied regularity into implied volatility models: A study on free arbitrage model

Daniele Angelini, Fabrizio Di Sciorio

No citations found for this paper.

Comments (0)