Summary

Affine Diffusion dynamics are frequently used for Valuation Adjustments (xVA) calculations due to their analytic tractability. However, these models cannot capture the market-implied skew and smile, which are relevant when computing xVA metrics. Hence, additional degrees of freedom are required to capture these market features. In this paper, we address this through an SDE with state-dependent coefficients. The SDE is consistent with the convex combination of a finite number of different AD dynamics. We combine Hull-White one-factor models where one model parameter is varied. We use the Randomized AD (RAnD) technique to parameterize the combination of dynamics. We refer to our SDE with state-dependent coefficients and the RAnD parametrization of the original models as the rHW model. The rHW model allows for efficient semi-analytic calibration to European swaptions through the analytic tractability of the Hull-White dynamics. We use a regression-based Monte-Carlo simulation to calculate exposures. In this setting, we demonstrate the significant effect of skew and smile on exposures and xVAs of linear and early-exercise interest rate derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

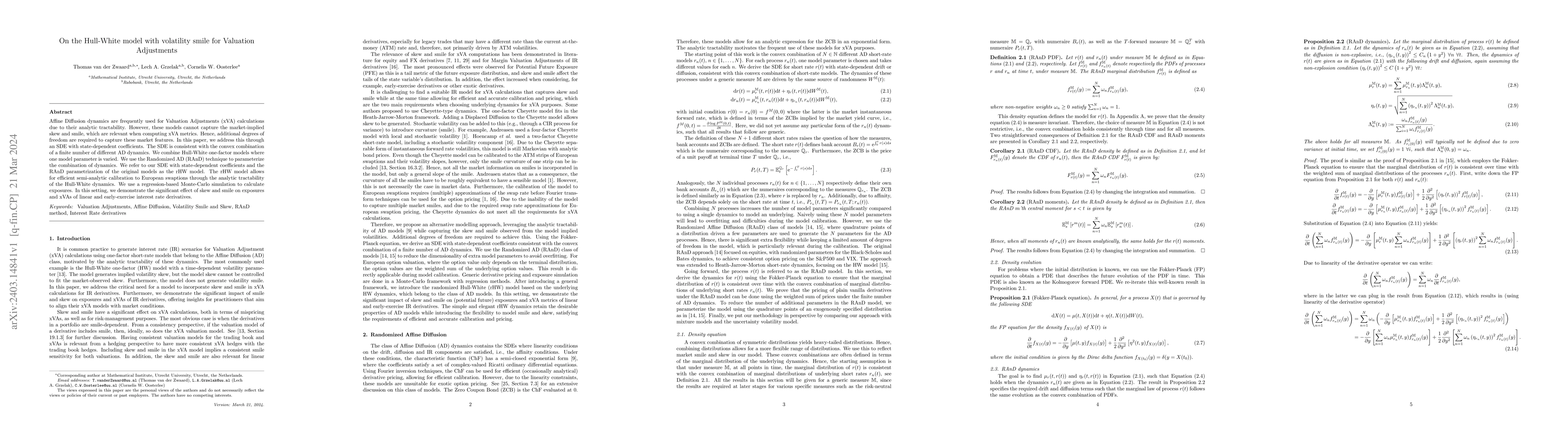

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)