Summary

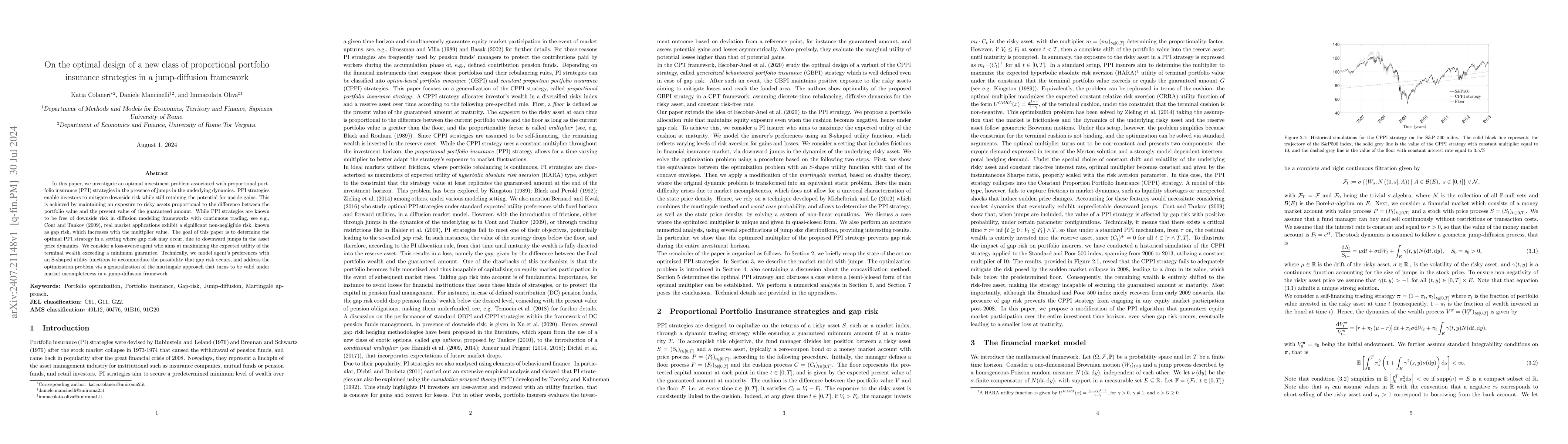

In this paper, we investigate an optimal investment problem associated with proportional portfolio insurance (PPI) strategies in the presence of jumps in the underlying dynamics. PPI strategies enable investors to mitigate downside risk while still retaining the potential for upside gains. This is achieved by maintaining an exposure to risky assets proportional to the difference between the portfolio value and the present value of the guaranteed amount. While PPI strategies are known to be free of downside risk in diffusion modeling frameworks with continuous trading, see e.g., Cont and Tankov (2009), real market applications exhibit a significant non-negligible risk, known as gap risk, which increases with the multiplier value. The goal of this paper is to determine the optimal PPI strategy in a setting where gap risk may occur, due to downward jumps in the asset price dynamics. We consider a loss-averse agent who aims at maximizing the expected utility of the terminal wealth exceeding a minimum guarantee. Technically, we model agent's preferences with an S-shaped utility functions to accommodate the possibility that gap risk occurs, and address the optimization problem via a generalization of the martingale approach that turns to be valid under market incompleteness in a jump-diffusion framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)