Summary

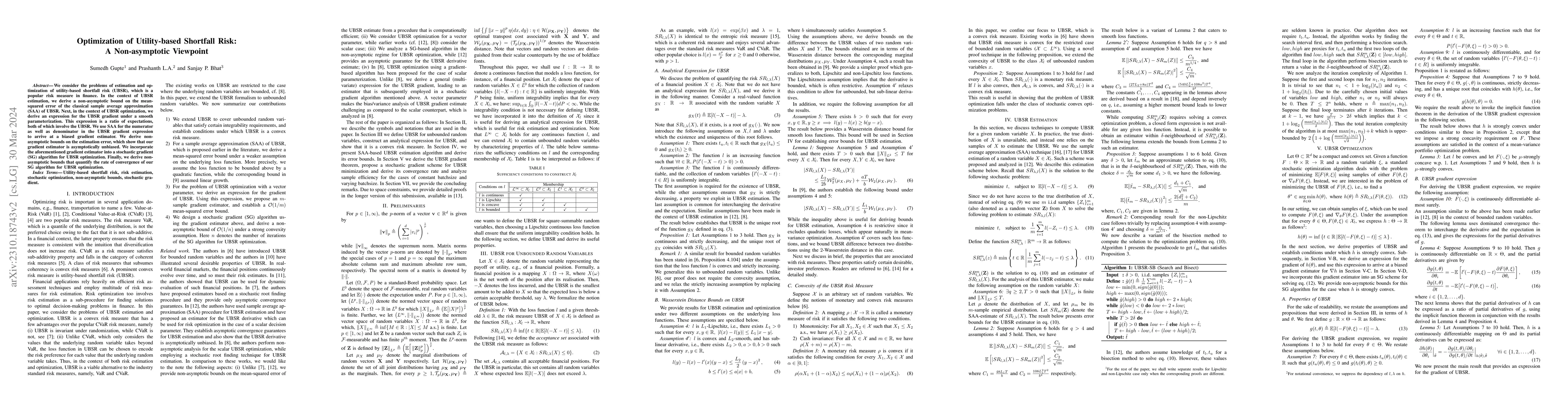

We consider the problems of estimation and optimization of utility-based shortfall risk (UBSR), which is a popular risk measure in finance. In the context of UBSR estimation, we derive a non-asymptotic bound on the mean-squared error of the classical sample average approximation (SAA) of UBSR. Next, in the context of UBSR optimization, we derive an expression for the UBSR gradient under a smooth parameterization. This expression is a ratio of expectations, both of which involve the UBSR. We use SAA for the numerator as well as denominator in the UBSR gradient expression to arrive at a biased gradient estimator. We derive non-asymptotic bounds on the estimation error, which show that our gradient estimator is asymptotically unbiased. We incorporate the aforementioned gradient estimator into a stochastic gradient (SG) algorithm for UBSR optimization. Finally, we derive non-asymptotic bounds that quantify the rate of convergence of our SG algorithm for UBSR optimization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOnline Estimation and Optimization of Utility-Based Shortfall Risk

Krishna Jagannathan, L. A. Prashanth, Vishwajit Hegde et al.

An Alternating Direction Method of Multipliers for Utility-based Shortfall Risk Portfolio Optimization

Rujun Jiang, Rufeng Xiao, Zhiping Li

Learning to optimize convex risk measures: The cases of utility-based shortfall risk and optimized certainty equivalent risk

Sumedh Gupte, Prashanth L. A., Sanjay P. Bhat

On the equivalence between Value-at-Risk- and Expected Shortfall-based risk measures in non-concave optimization

An Chen, Mitja Stadje, Fangyuan Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)