Summary

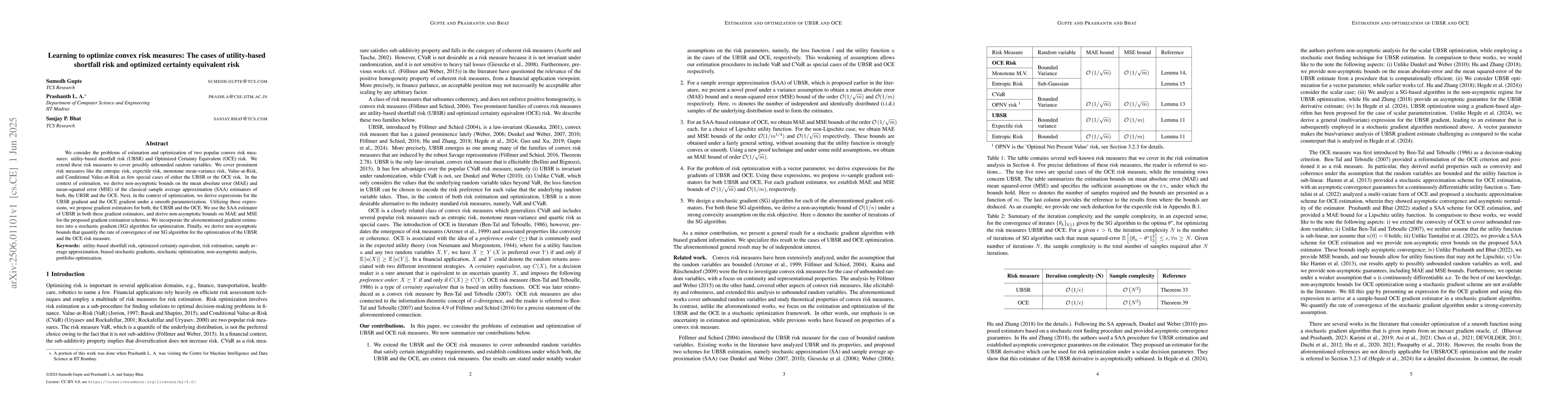

We consider the problems of estimation and optimization of two popular convex risk measures: utility-based shortfall risk (UBSR) and Optimized Certainty Equivalent (OCE) risk. We extend these risk measures to cover possibly unbounded random variables. We cover prominent risk measures like the entropic risk, expectile risk, monotone mean-variance risk, Value-at-Risk, and Conditional Value-at-Risk as few special cases of either the UBSR or the OCE risk. In the context of estimation, we derive non-asymptotic bounds on the mean absolute error (MAE) and mean-squared error (MSE) of the classical sample average approximation (SAA) estimators of both, the UBSR and the OCE. Next, in the context of optimization, we derive expressions for the UBSR gradient and the OCE gradient under a smooth parameterization. Utilizing these expressions, we propose gradient estimators for both, the UBSR and the OCE. We use the SAA estimator of UBSR in both these gradient estimators, and derive non-asymptotic bounds on MAE and MSE for the proposed gradient estimation schemes. We incorporate the aforementioned gradient estimators into a stochastic gradient (SG) algorithm for optimization. Finally, we derive non-asymptotic bounds that quantify the rate of convergence of our SG algorithm for the optimization of the UBSR and the OCE risk measure.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper extends utility-based shortfall risk (UBSR) and Optimized Certainty Equivalent (OCE) risk measures to cover unbounded random variables, deriving non-asymptotic bounds for their estimation errors and gradient expressions for optimization. Stochastic gradient (SG) algorithms are proposed and analyzed for these risk measures.

Key Results

- Non-asymptotic bounds on mean absolute error (MAE) and mean-squared error (MSE) for SAA estimators of UBSR and OCE.

- Gradient expressions for UBSR and OCE under smooth parameterization.

- Gradient estimation schemes for UBSR and OCE with non-asymptotic MAE and MSE bounds.

- Stochastic gradient (SG) algorithm for optimization of UBSR and OCE risk measures.

- Non-asymptotic convergence bounds for the SG algorithm in optimizing UBSR and OCE.

Significance

This research contributes to financial risk management by providing efficient estimation and optimization techniques for convex risk measures, which can be applied to various prominent risk measures, thus improving decision-making under uncertainty.

Technical Contribution

The paper presents novel gradient estimators and non-asymptotic convergence bounds for stochastic gradient algorithms applied to utility-based shortfall risk and optimized certainty equivalent risk measures.

Novelty

This work extends existing risk measure optimization techniques to unbounded random variables and provides new gradient estimation schemes with theoretical convergence guarantees, covering a wide range of prominent risk measures as special cases.

Limitations

- The paper does not address the computational complexity of the proposed methods.

- Real-world applicability and empirical validation are not explored.

Future Work

- Investigate computational complexity and develop efficient numerical methods for the proposed gradient estimators.

- Conduct empirical studies to validate the performance of the proposed methods on real financial datasets.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMultivariate Optimized Certainty Equivalent Risk Measures and their Numerical Computation

Anis Matoussi, Sarah Kaakai, Achraf Tamtalini

Concentration Bounds for Optimized Certainty Equivalent Risk Estimation

Krishna Jagannathan, L. A. Prashanth, Ayon Ghosh

Decision-making under risk: when is utility maximization equivalent to risk minimization?

Francesco Ruscitti, Ram Sewak Dubey, Giorgio Laguzzi

No citations found for this paper.

Comments (0)