Authors

Summary

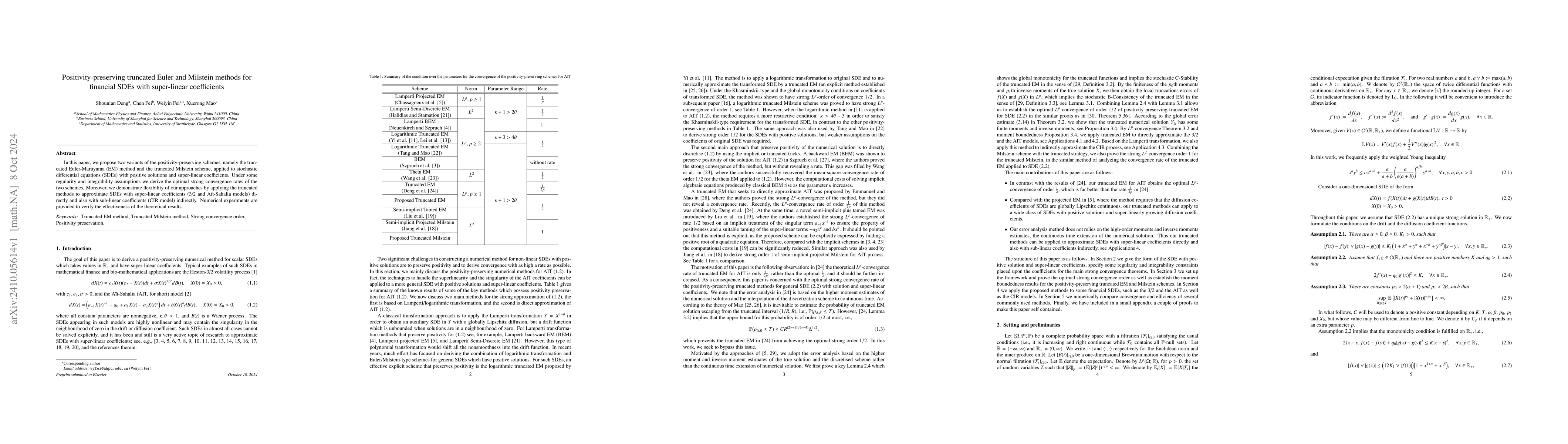

In this paper, we propose two variants of the positivity-preserving schemes, namely the truncated Euler-Maruyama (EM) method and the truncated Milstein scheme, applied to stochastic differential equations (SDEs) with positive solutions and super-linear coefficients. Under some regularity and integrability assumptions we derive the optimal strong convergence rates of the two schemes. Moreover, we demonstrate flexibility of our approaches by applying the truncated methods to approximate SDEs with super-linear coefficients (3/2 and Ai{\i}t-Sahalia models) directly and also with sub-linear coefficients (CIR model) indirectly. Numerical experiments are provided to verify the effectiveness of the theoretical results.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper proposes two positivity-preserving numerical schemes, the truncated Euler-Maruyama (EM) method and the truncated Milstein scheme, for stochastic differential equations (SDEs) with positive solutions and super-linear coefficients. It derives optimal strong convergence rates under certain regularity and integrability assumptions.

Key Results

- Two positivity-preserving schemes, truncated EM and Milstein, are proposed for SDEs with super-linear coefficients.

- Optimal strong convergence rates are derived for both schemes under specific conditions.

- The methods are demonstrated to be flexible by applying them to SDEs with both super-linear (3/2 and Ai{\i}t-Sahalia models) and sub-linear (CIR model) coefficients.

- Numerical experiments validate the theoretical convergence rates.

Significance

This research is significant as it addresses the approximation of SDEs with super-linear coefficients, ensuring positivity of numerical solutions, which is crucial in financial modeling where solution positivity is essential.

Technical Contribution

The paper presents novel truncated EM and Milstein schemes that maintain positivity of solutions, along with rigorous convergence rate analysis for SDEs with super-linear coefficients.

Novelty

The work introduces positivity-preserving properties to truncated EM and Milstein methods, which are not commonly addressed in existing literature, making it a novel contribution to numerical methods for SDEs in finance.

Limitations

- The methods are primarily theoretical and their practical implementation might require careful consideration of computational costs.

- The paper does not explore the application of these methods to more complex financial models with multiple interacting assets.

Future Work

- Investigate the application of these methods to more complex financial models.

- Explore adaptive step-size control for improved computational efficiency.

- Extend the analysis to handle SDEs with jump-diffusion processes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMilstein-type schemes for McKean-Vlasov SDEs driven by Brownian motion and Poisson random measure (with super-linear coefficients)

Christoph Reisinger, Verena Schwarz, Sani Biswas et al.

A positivity-preserving truncated Euler--Maruyama method for stochastic differential equations with positive solutions: multi-dimensional case

Xinjie Dai, Aiguo Xiao, Xingwei Hu

Strong error analysis and first-order convergence of Milstein-type schemes for McKean-Vlasov SDEs with superlinear coefficients

Yuying Zhao, Siqing Gan, Jingtao Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)