Summary

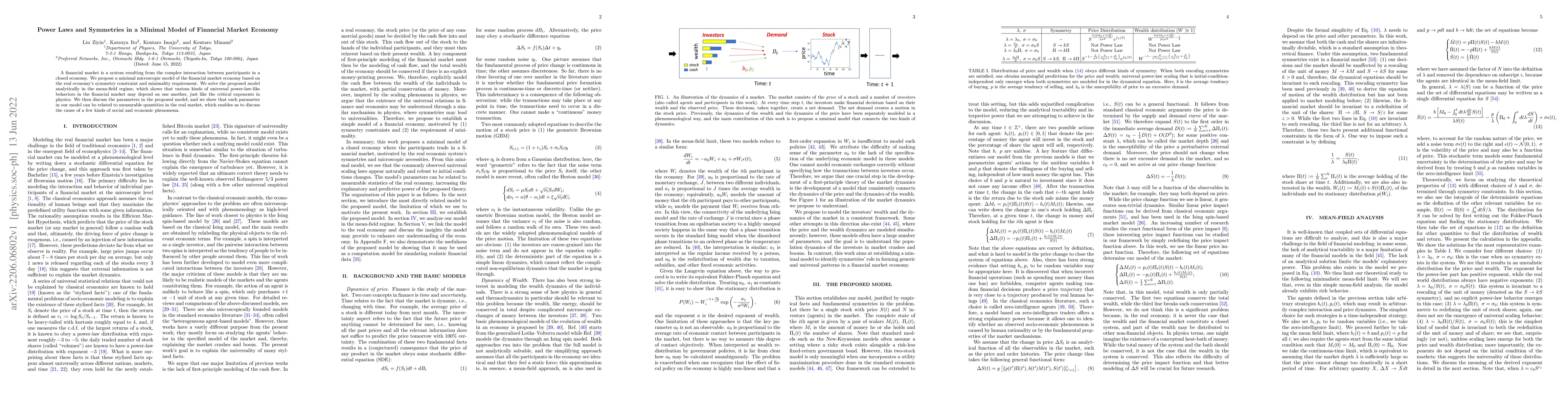

A financial market is a system resulting from the complex interaction between participants in a closed economy. We propose a minimal microscopic model of the financial market economy based on the real economy's symmetry constraint and minimality requirement. We solve the proposed model analytically in the mean-field regime, which shows that various kinds of universal power-law-like behaviors in the financial market may depend on one another, just like the critical exponents in physics. We then discuss the parameters in the proposed model, and we show that each parameter in our model can be related to measurable quantities in the real market, which enables us to discuss the cause of a few kinds of social and economic phenomena.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLie Symmetry Net: Preserving Conservation Laws in Modelling Financial Market Dynamics via Differential Equations

Can Wang, Xuelian Jiang, Yingxiang Xu et al.

No citations found for this paper.

Comments (0)