Authors

Summary

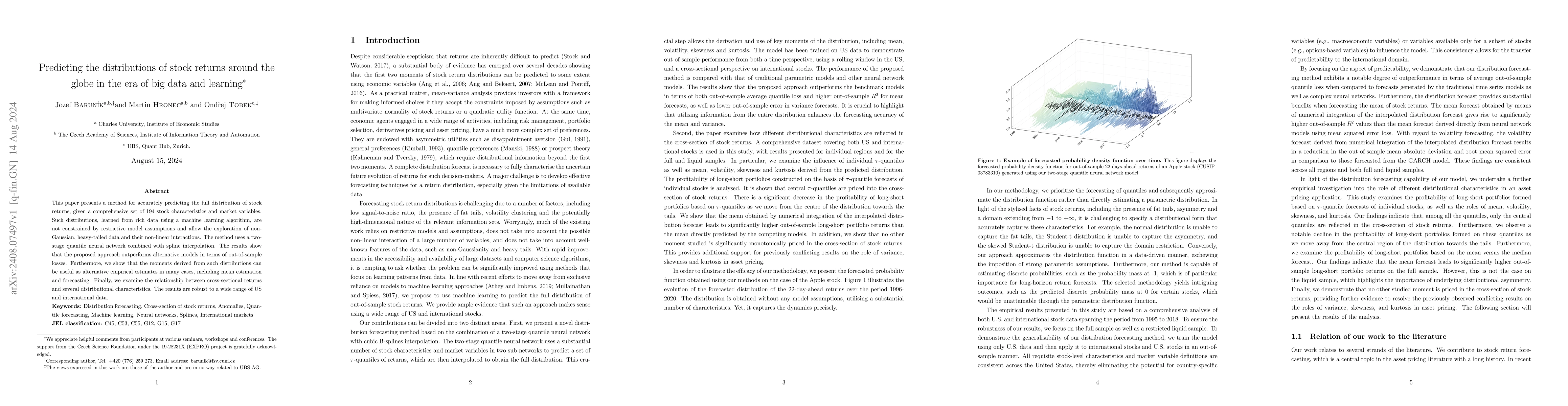

This paper presents a method for accurately predicting the full distribution of stock returns, given a comprehensive set of 194 stock characteristics and market variables. Such distributions, learned from rich data using a machine learning algorithm, are not constrained by restrictive model assumptions and allow the exploration of non-Gaussian, heavy-tailed data and their non-linear interactions. The method uses a two-stage quantile neural network combined with spline interpolation. The results show that the proposed approach outperforms alternative models in terms of out-of-sample losses. Furthermore, we show that the moments derived from such distributions can be useful as alternative empirical estimates in many cases, including mean estimation and forecasting. Finally, we examine the relationship between cross-sectional returns and several distributional characteristics. The results are robust to a wide range of US and international data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)