Summary

Cross-correlation analysis is a powerful tool for understanding the mutual dynamics of time series. This study introduces a new method for predicting the future state of synchronization of the dynamics of two financial time series. To this end, we use the cross-recurrence plot analysis as a nonlinear method for quantifying the multidimensional coupling in the time domain of two time series and for determining their state of synchronization. We adopt a deep learning framework for methodologically addressing the prediction of the synchronization state based on features extracted from dynamically sub-sampled cross-recurrence plots. We provide extensive experiments on several stocks, major constituents of the S\&P100 index, to empirically validate our approach. We find that the task of predicting the state of synchronization of two time series is in general rather difficult, but for certain pairs of stocks attainable with very satisfactory performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

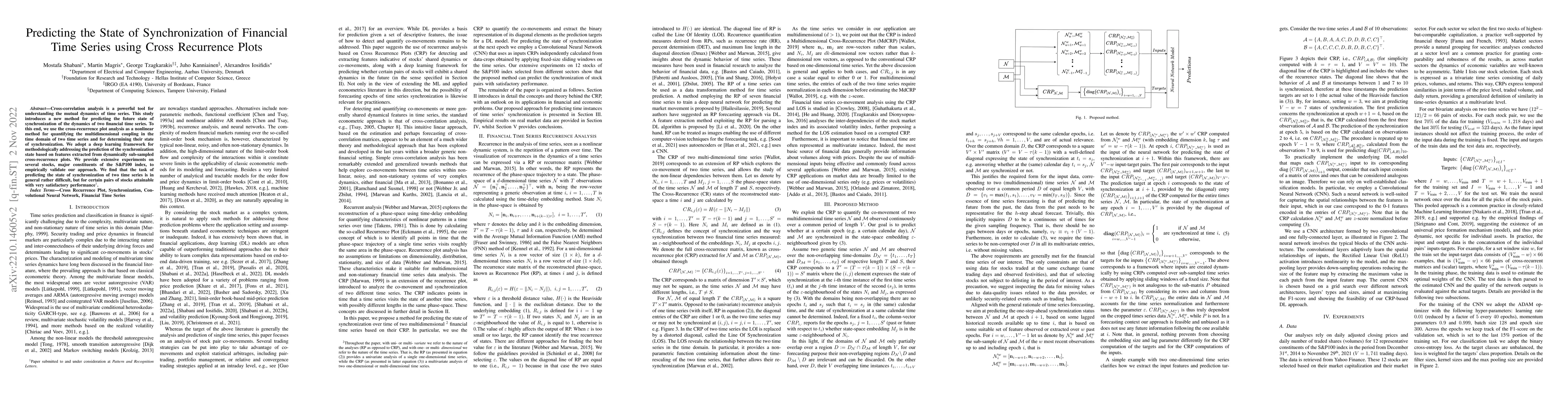

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMCI Detection using fMRI time series embeddings of Recurrence plots

Ninad Aithal, Neelam Sinha, Chakka Sai Pradeep

Deep learning for classifying dynamical states from time series via recurrence plots

G. Ambika, Athul Mohan, Chandrakala Meena

| Title | Authors | Year | Actions |

|---|

Comments (0)