Authors

Summary

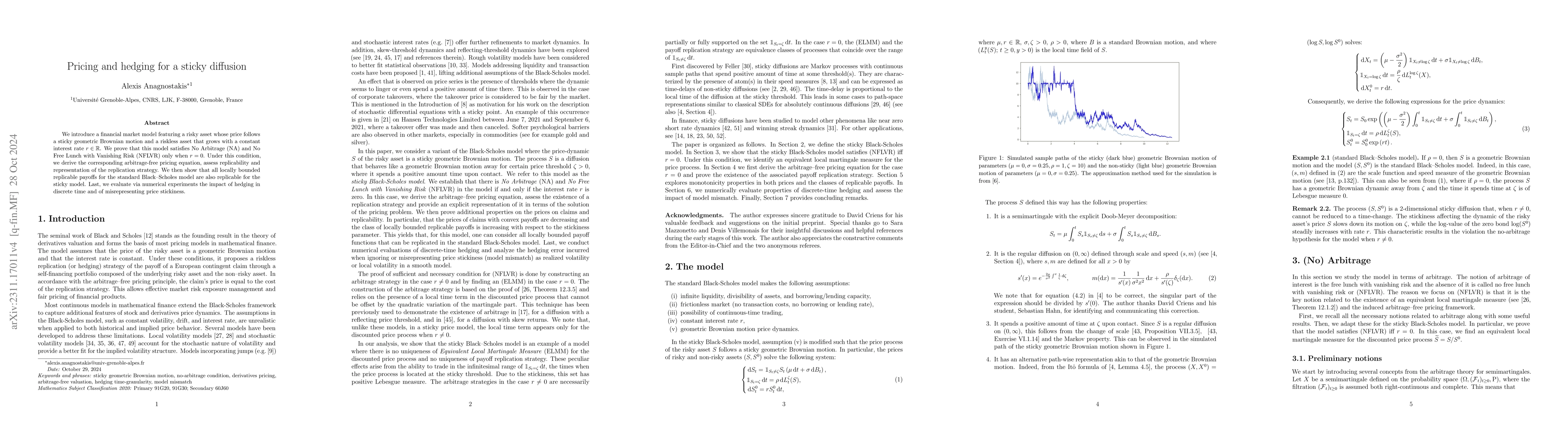

We consider a financial market model featuring a risky asset with a sticky geometric Brownian motion price dynamic and a constant interest rate $r \in \mathbb R$. We prove that the model is arbitrage-free if and only if $r =0 $. In this case, we find the unique riskless replication strategy, derive the associated pricing equation. We also identify a class of replicable payoffs that coincides with the replicable payoffs in the standard Black-Scholes model. Last, we numerically evaluate discrete-time hedging and the hedging error incurred from misrepresenting price stickiness.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing and Hedging Strategies for Cross-Currency Equity Protection Swaps

Huansang Xu, Marek Rutkowski

Hedging and Pricing Structured Products Featuring Multiple Underlying Assets

Anil Sharma, Freeman Chen, Jaesun Noh et al.

No citations found for this paper.

Comments (0)