Summary

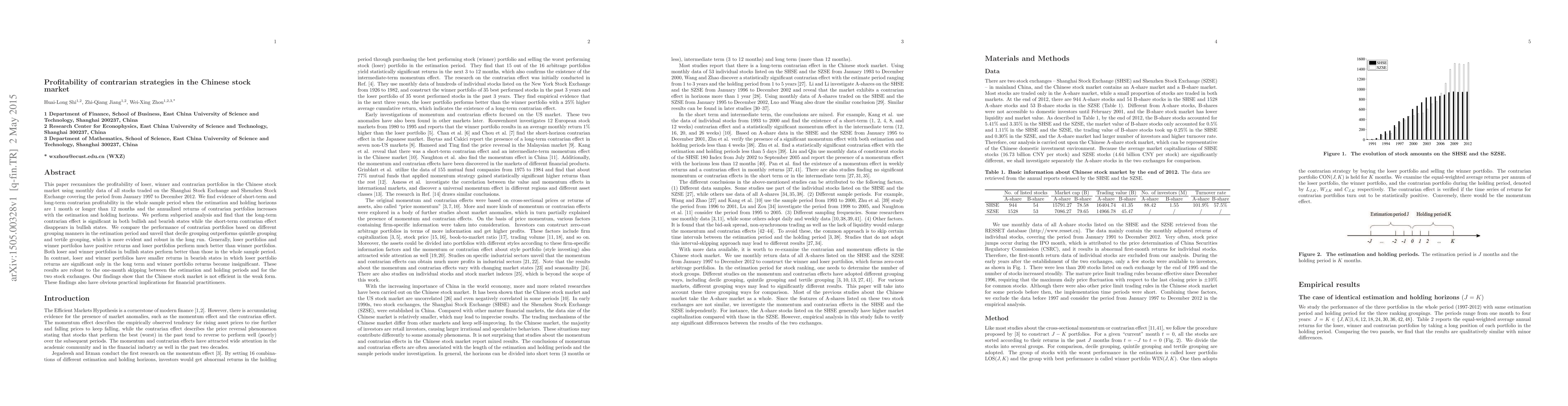

This paper reexamines the profitability of loser, winner and contrarian portfolios in the Chinese stock market using monthly data of all stocks traded on the Shanghai Stock Exchange and Shenzhen Stock Exchange covering the period from January 1997 to December 2012. We find evidence of short-term and long-term contrarian profitability in the whole sample period when the estimation and holding horizons are 1 month or longer than 12 months and the annualized returns of contrarian portfolios increases with the estimation and holding horizons. We perform subperiod analysis and find that the long-term contrarian effect is significant in both bullish and bearish states while the short-term contrarian effect disappears in bullish states. We compare the performance of contrarian portfolios based on different grouping manners in the estimation period and unveil that decile grouping outperforms quintile grouping and tertile grouping, which is more evident and robust in the long run. Generally, loser portfolios and winner portfolios have positive returns and loser portfolios perform much better than winner portfolios. Both loser and winner portfolios in bullish states perform better than those in the whole sample period. In contrast, loser and winner portfolios have smaller returns in bearish states in which loser portfolio returns are significant only in the long term and winner portfolio returns become insignificant. These results are robust to the one-month skipping between the estimation and holding periods and for the two stock exchanges. Our findings show that the Chinese stock market is not efficient in the weak form. These findings also have obvious practical implications for financial practitioners.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)