Summary

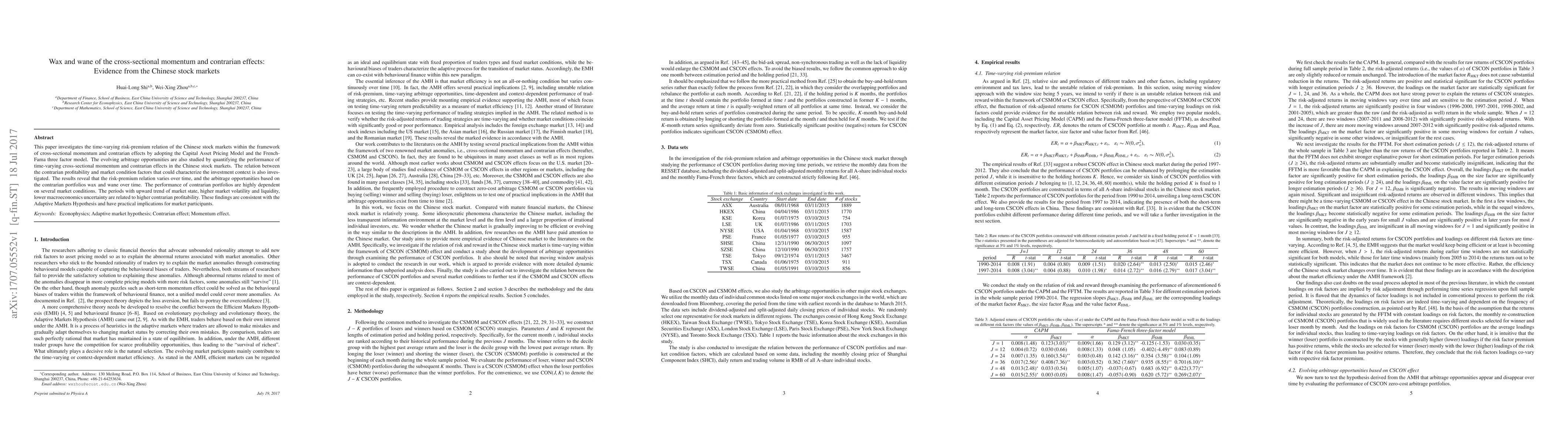

This paper investigates the time-varying risk-premium relation of the Chinese stock markets within the framework of cross-sectional momentum and contrarian effects by adopting the Capital Asset Pricing Model and the French-Fama three factor model. The evolving arbitrage opportunities are also studied by quantifying the performance of time-varying cross-sectional momentum and contrarian effects in the Chinese stock markets. The relation between the contrarian profitability and market condition factors that could characterize the investment context is also investigated. The results reveal that the risk-premium relation varies over time, and the arbitrage opportunities based on the contrarian portfolios wax and wane over time. The performance of contrarian portfolios are highly dependent on several market conditions. The periods with upward trend of market state, higher market volatility and liquidity, lower macroeconomics uncertainty are related to higher contrarian profitability. These findings are consistent with the Adaptive Markets Hypothesis and have practical implications for market participants.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)