Summary

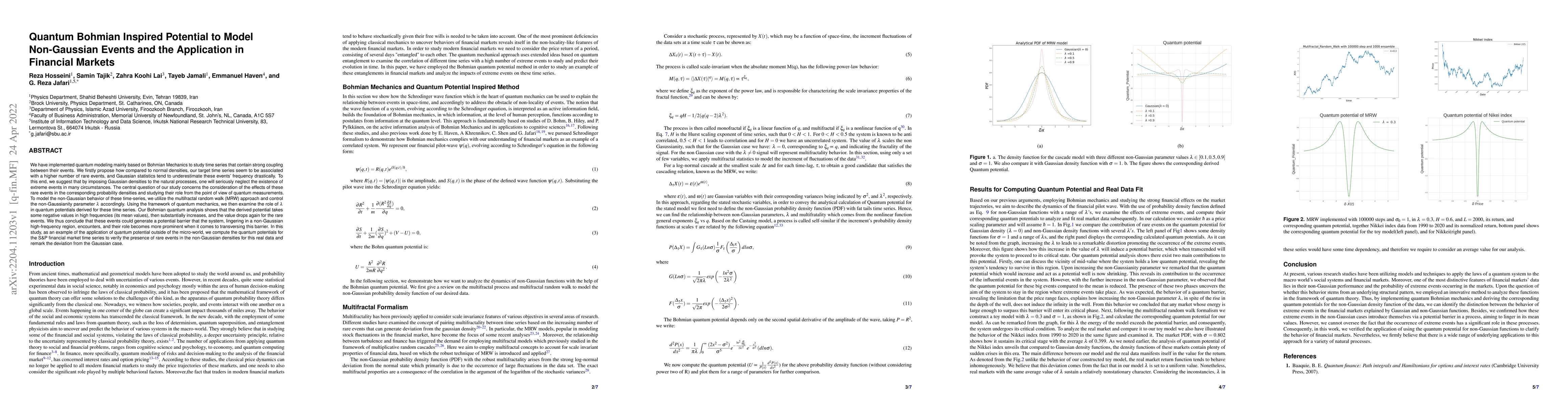

We have implemented quantum modeling mainly based on Bohmian Mechanics to study time series that contain strong coupling between their events. We firstly propose how compared to normal densities, our target time series seem to be associated with a higher number of rare events, and Gaussian statistics tend to underestimate these events' frequency drastically. To this end, we suggest that by imposing Gaussian densities to the natural processes, one will seriously neglect the existence of extreme events in many circumstances. The central question of our study concerns the consideration of the effects of these rare events in the corresponding probability densities and studying their role from the point of view of quantum measurements. To model the non-Gaussian behavior of these time-series, we utilize the multifractal random walk (MRW) approach and control the non-Gaussianity parameter $\lambda$ accordingly. Using the framework of quantum mechanics, we then examine the role of $\lambda$ in quantum potentials derived for these time series. Our Bohmian quantum analysis shows that the derived potential takes some negative values in high frequencies (its mean values), then substantially increases, and the value drops again for the rare events. We thus conclude that these events could generate a potential barrier that the system, lingering in a non-Gaussian high-frequency region, encounters, and their role becomes more prominent when it comes to transversing this barrier. In this study, as an example of the application of quantum potential outside of the micro-world, we compute the quantum potentials for the S\&P financial market time series to verify the presence of rare events in the non-Gaussian densities for this real data and remark the deviation from the Gaussian case.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)