Summary

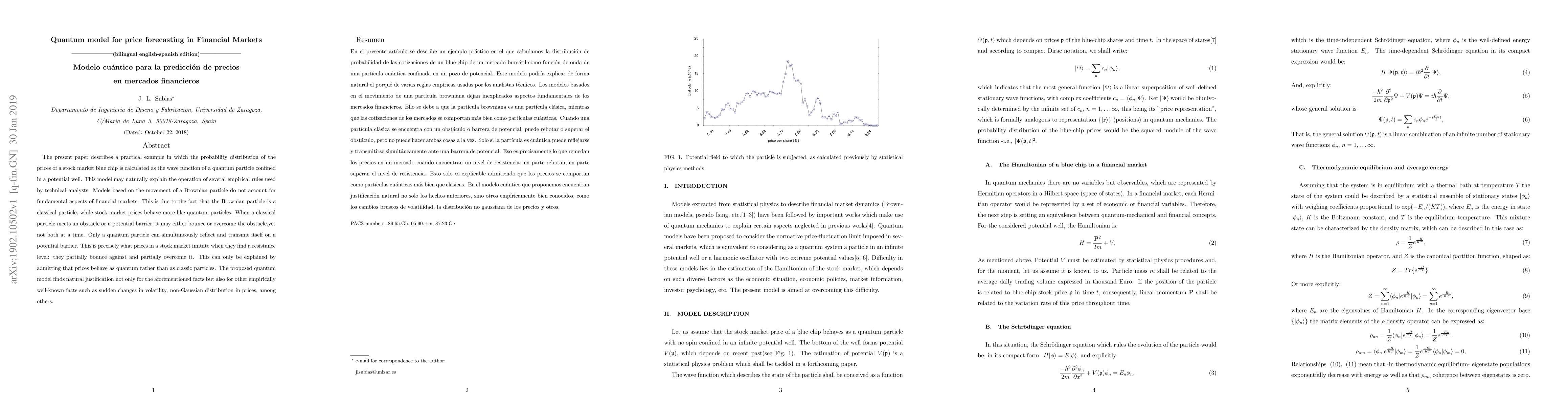

The present paper describes a practical example in which the probability distribution of the prices of a stock market blue chip is calculated as the wave function of a quantum particle confined in a potential well. This model may naturally explain the operation of several empirical rules used by technical analysts. Models based on the movement of a Brownian particle do not account for fundamental aspects of financial markets. This is due to the fact that the Brownian particle is a classical particle, while stock market prices behave more like quantum particles. When a classical particle meets an obstacle or a potential barrier, it may either bounce or overcome the obstacle, yet not both at a time. Only a quantum particle can simultaneously reflect and transmit itself on a potential barrier. This is precisely what prices in a stock market imitate when they find a resistance level: they partially bounce against and partially overcome it. This can only be explained by admitting that prices behave as quantum rather than as classic particles. The proposed quantum model finds natural justification not only for the aforementioned facts but also for other empirically well-known facts such as sudden changes in volatility, non-Gaussian distribution in prices, among others.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)