Summary

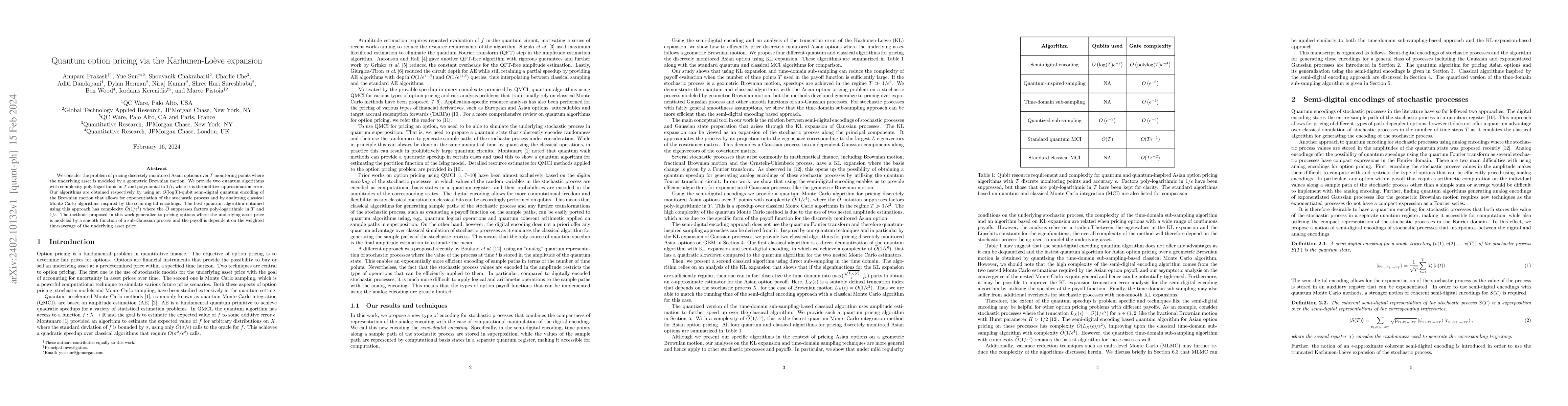

We consider the problem of pricing discretely monitored Asian options over $T$ monitoring points where the underlying asset is modeled by a geometric Brownian motion. We provide two quantum algorithms with complexity poly-logarithmic in $T$ and polynomial in $1/\epsilon$, where $\epsilon$ is the additive approximation error. Our algorithms are obtained respectively by using an $O(\log T)$-qubit semi-digital quantum encoding of the Brownian motion that allows for exponentiation of the stochastic process and by analyzing classical Monte Carlo algorithms inspired by the semi-digital encodings. The best quantum algorithm obtained using this approach has complexity $\widetilde{O}(1/\epsilon^{3})$ where the $\widetilde{O}$ suppresses factors poly-logarithmic in $T$ and $1/\epsilon$. The methods proposed in this work generalize to pricing options where the underlying asset price is modeled by a smooth function of a sub-Gaussian process and the payoff is dependent on the weighted time-average of the underlying asset price.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)