Summary

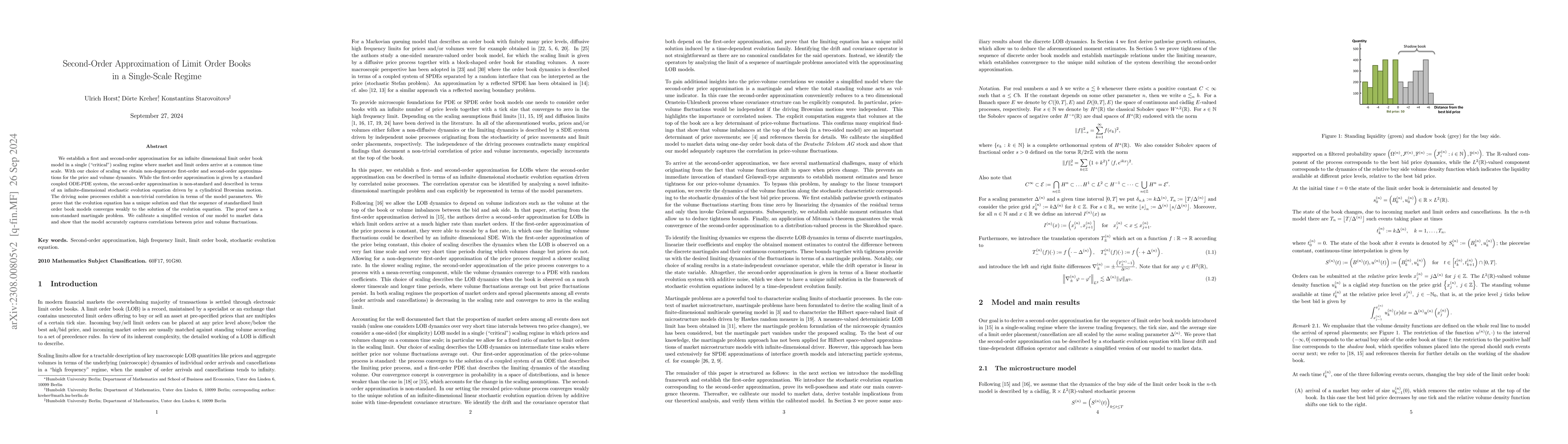

We establish a first and second-order approximation for an infinite dimensional limit order book model (LOB) in a single (''critical'') scaling regime where market and limit orders arrive at a common time scale. With our choice of scaling we obtain non-degenerate first-order and second-order approximations for the price and volume dynamics. While the first-order approximation is given by a standard coupled ODE-PDE system, the second-order approximation is non-standard and described in terms of an infinite-dimensional stochastic evolution equation driven by a cylindrical Brownian motion. The driving noise processes exhibit a non-trivial correlation in terms of the model parameters. We prove that the evolution equation has a unique solution and that the sequence of standardized LOB models converges weakly to the solution of the evolution equation. The proof uses a non-standard martingale problem. We calibrate a simplified version of our model to market data and show that the model accurately captures correlations between price and volume fluctuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)