Summary

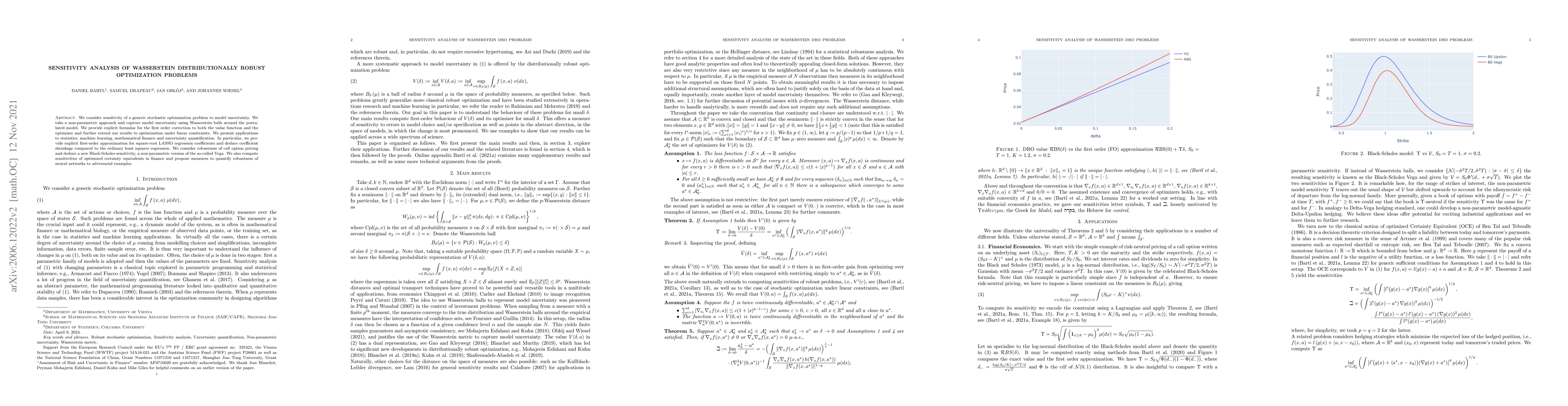

We consider sensitivity of a generic stochastic optimization problem to model uncertainty. We take a non-parametric approach and capture model uncertainty using Wasserstein balls around the postulated model. We provide explicit formulae for the first order correction to both the value function and the optimizer and further extend our results to optimization under linear constraints. We present applications to statistics, machine learning, mathematical finance and uncertainty quantification. In particular, we provide explicit first-order approximation for square-root LASSO regression coefficients and deduce coefficient shrinkage compared to the ordinary least squares regression. We consider robustness of call option pricing and deduce a new Black-Scholes sensitivity, a non-parametric version of the so-called Vega. We also compute sensitivities of optimized certainty equivalents in finance and propose measures to quantify robustness of neural networks to adversarial examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRegularization for Wasserstein Distributionally Robust Optimization

Waïss Azizian, Franck Iutzeler, Jérôme Malick

Wasserstein Distributionally Robust Regret Optimization

Jose Blanchet, Lukas-Benedikt Fiechtner

Wasserstein Distributionally Robust Optimization with Wasserstein Barycenters

Han Liu, Tim Tsz-Kit Lau

Coresets for Wasserstein Distributionally Robust Optimization Problems

Jiawei Huang, Ruomin Huang, Hu Ding et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)