Authors

Summary

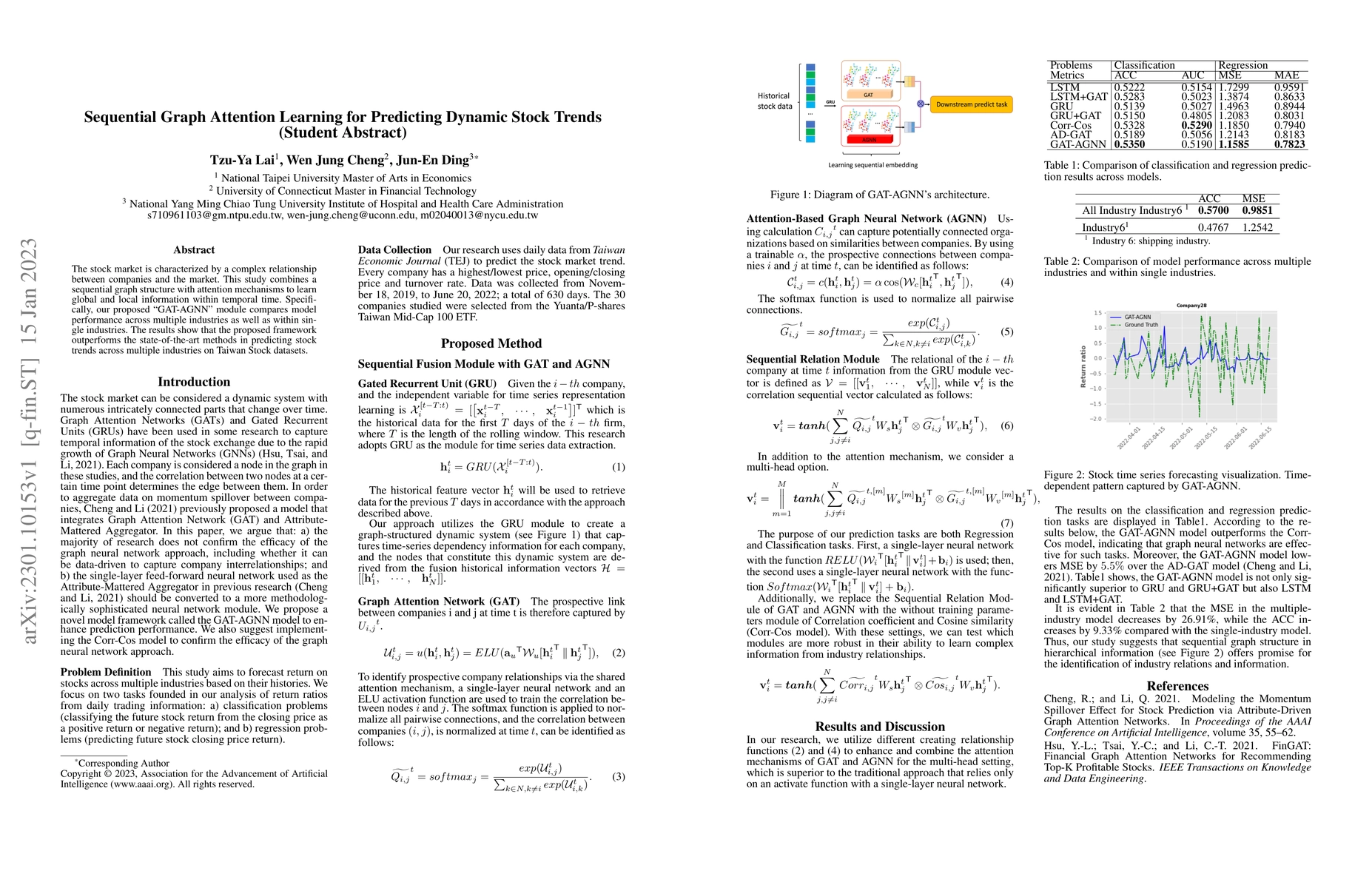

The stock market is characterized by a complex relationship between companies and the market. This study combines a sequential graph structure with attention mechanisms to learn global and local information within temporal time. Specifically, our proposed "GAT-AGNN" module compares model performance across multiple industries as well as within single industries. The results show that the proposed framework outperforms the state-of-the-art methods in predicting stock trends across multiple industries on Taiwan Stock datasets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIncremental Learning of Stock Trends via Meta-Learning with Dynamic Adaptation

Qing Li, Zheng Liu, Shiluo Huang et al.

MDGNN: Multi-Relational Dynamic Graph Neural Network for Comprehensive and Dynamic Stock Investment Prediction

Hao Chen, Zhiqiang Zhang, Jun Zhou et al.

Multi-relational Graph Diffusion Neural Network with Parallel Retention for Stock Trends Classification

Jin Zheng, Zinuo You, Pengju Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)