Summary

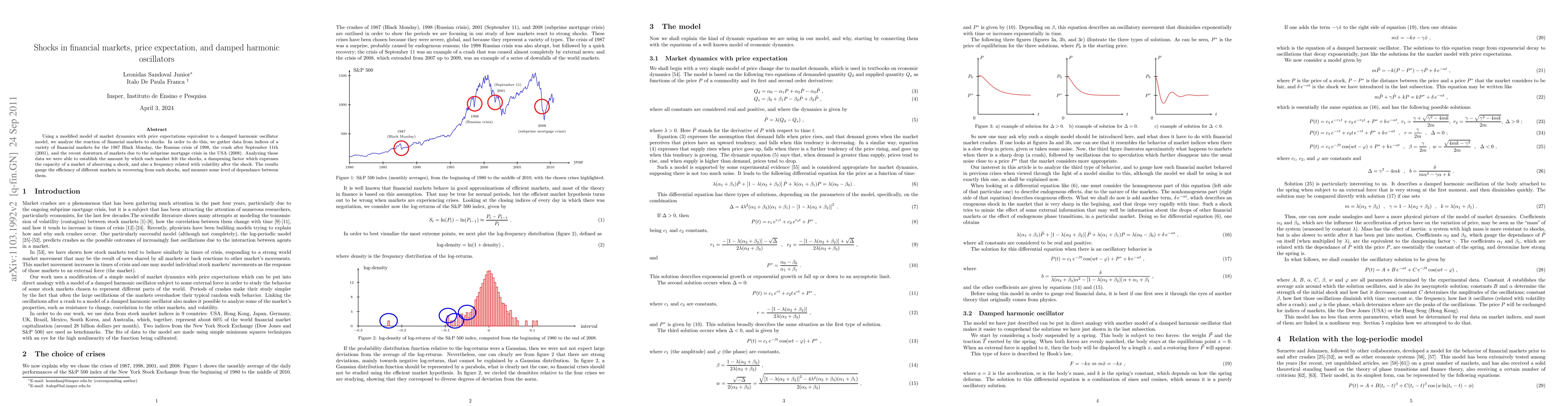

Using a modified damped harmonic oscillator model equivalent to a model of market dynamics with price expectations, we analyze the reaction of financial markets to shocks. In order to do this, we gather data from indices of a variety of financial markets for the 1987 Black Monday, the Russian crisis of 1998, the crash after September 11th (2001), and the recent downturn of markets due to the subprime mortgage crisis in the USA (2008). Analyzing those data we were able to establish the amount by which each market felt the shocks, a dampening factor which expresses the capacity of a market of absorving a shock, and also a frequency related with volatility after the shock. The results gauge the efficiency of different markets in recovering from such shocks, and measure some level of dependence between them. We also show, using the correlation matrices between the indices used, that financial markets are now much more connected than they were two decades ago.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)