Summary

Applying machine learning methods to forecast stock prices has been one of the research topics of interest in recent years. Almost few studies have been reported based on generative adversarial networks (GANs) in this area, but their results are promising. GANs are powerful generative models successfully applied in different areas but suffer from inherent challenges such as training instability and mode collapse. Also, a primary concern is capturing correlations in stock prices. Therefore, our challenges fall into two main categories: capturing correlations and inherent problems of GANs. In this paper, we have introduced a novel framework based on DRAGAN and feature matching for stock price forecasting, which improves training stability and alleviates mode collapse. We have employed windowing to acquire temporal correlations by the generator. Also, we have exploited conditioning on discriminator inputs to capture temporal correlations and correlations between prices and features. Experimental results on data from several stocks indicate that our proposed method outperformed long short-term memory (LSTM) as a baseline method, also basic GANs and WGAN-GP as two different variants of GANs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

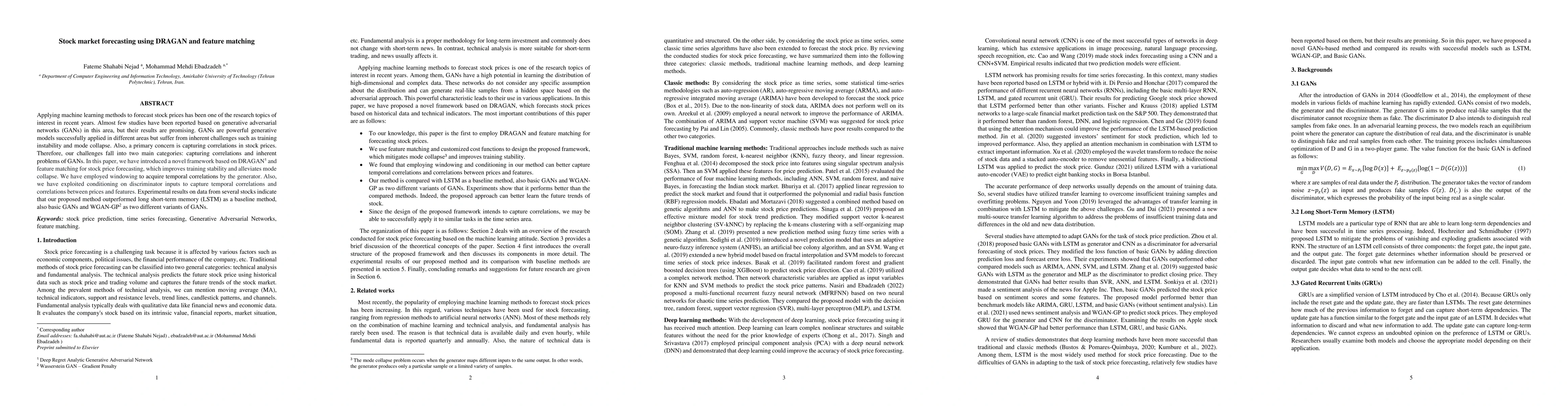

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMASTER: Market-Guided Stock Transformer for Stock Price Forecasting

Yanyan Shen, Zhaoyang Liu, Tong Li et al.

Global Stock Market Volatility Forecasting Incorporating Dynamic Graphs and All Trading Days

Junbin Gao, Chao Wang, Zhengyang Chi

A Neuro-Fuzzy System for Interpretable Long-Term Stock Market Forecasting

Vitomir Štruc, Igor Škrjanc, Miha Ožbot

| Title | Authors | Year | Actions |

|---|

Comments (0)