Summary

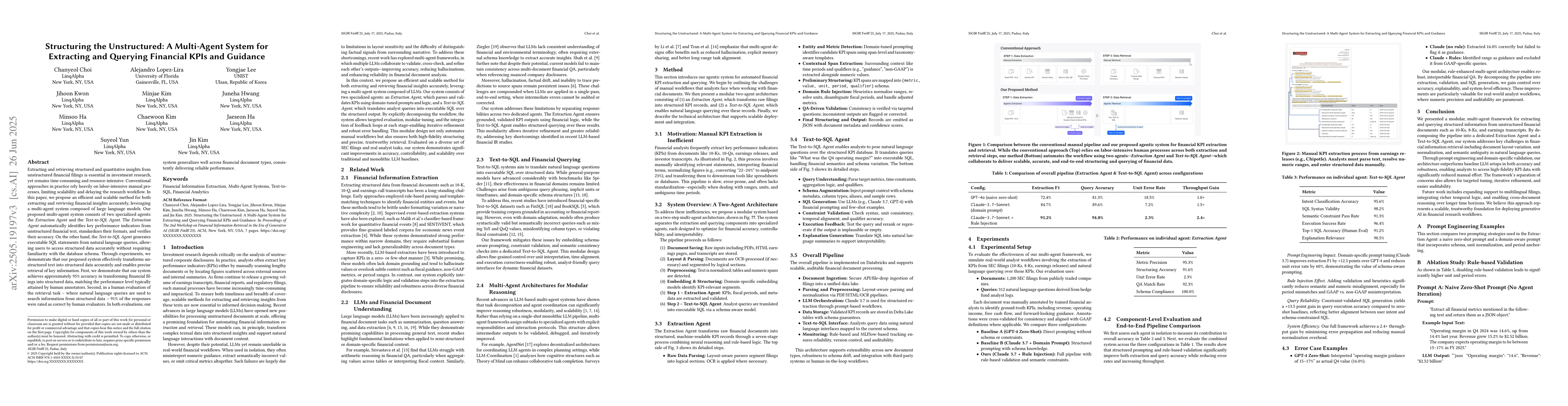

Extracting structured and quantitative insights from unstructured financial filings is essential in investment research, yet remains time-consuming and resource-intensive. Conventional approaches in practice rely heavily on labor-intensive manual processes, limiting scalability and delaying the research workflow. In this paper, we propose an efficient and scalable method for accurately extracting quantitative insights from unstructured financial documents, leveraging a multi-agent system composed of large language models. Our proposed multi-agent system consists of two specialized agents: the \emph{Extraction Agent} and the \emph{Text-to-SQL Agent}. The \textit{Extraction Agent} automatically identifies key performance indicators from unstructured financial text, standardizes their formats, and verifies their accuracy. On the other hand, the \textit{Text-to-SQL Agent} generates executable SQL statements from natural language queries, allowing users to access structured data accurately without requiring familiarity with the database schema. Through experiments, we demonstrate that our proposed system effectively transforms unstructured text into structured data accurately and enables precise retrieval of key information. First, we demonstrate that our system achieves approximately 95\% accuracy in transforming financial filings into structured data, matching the performance level typically attained by human annotators. Second, in a human evaluation of the retrieval task -- where natural language queries are used to search information from structured data -- 91\% of the responses were rated as correct by human evaluators. In both evaluations, our system generalizes well across financial document types, consistently delivering reliable performance.

AI Key Findings

Generated Jun 07, 2025

Methodology

The research proposes a multi-agent system for extracting and querying financial KPIs from unstructured financial documents, comprising an Extraction Agent and a Text-to-SQL Agent.

Key Results

- The system achieves approximately 95% accuracy in transforming financial filings into structured data, comparable to human annotators.

- In a human evaluation of the retrieval task, 91% of the responses generated by the system were rated as correct.

Significance

This research is significant as it offers an efficient and scalable method for extracting structured insights from unstructured financial documents, potentially streamlining investment research workflows and reducing reliance on labor-intensive manual processes.

Technical Contribution

The primary technical contribution is the development of a multi-agent system utilizing large language models for accurate extraction and querying of financial KPIs from unstructured text.

Novelty

The novelty of this work lies in its application of a multi-agent system with specialized agents for extraction and SQL query generation, addressing the challenge of transforming unstructured financial data into structured, queryable formats efficiently.

Limitations

- The paper does not discuss limitations explicitly, but potential limitations could include the system's performance on diverse or highly complex financial documents not represented in the training data.

- Generalizability to all types of financial filings and languages beyond English is not explicitly addressed.

Future Work

- Future work could focus on enhancing the system's performance on a broader range of financial document types and languages.

- Investigating the integration of real-time data feeds for more dynamic analysis could be an interesting avenue.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinTagging: An LLM-ready Benchmark for Extracting and Structuring Financial Information

Jimin Huang, Qianqian Xie, Yan Wang et al.

HedgeAgents: A Balanced-aware Multi-agent Financial Trading System

Xiangmin Xu, Jin Xu, Yawen Zeng et al.

FinTeam: A Multi-Agent Collaborative Intelligence System for Comprehensive Financial Scenarios

Wei Chen, Zhongyu Wei, Bingxuan Li et al.

MountainLion: A Multi-Modal LLM-Based Agent System for Interpretable and Adaptive Financial Trading

Tianyu Shi, Hanlin Zhang, Yi Xin et al.

No citations found for this paper.

Comments (0)