Summary

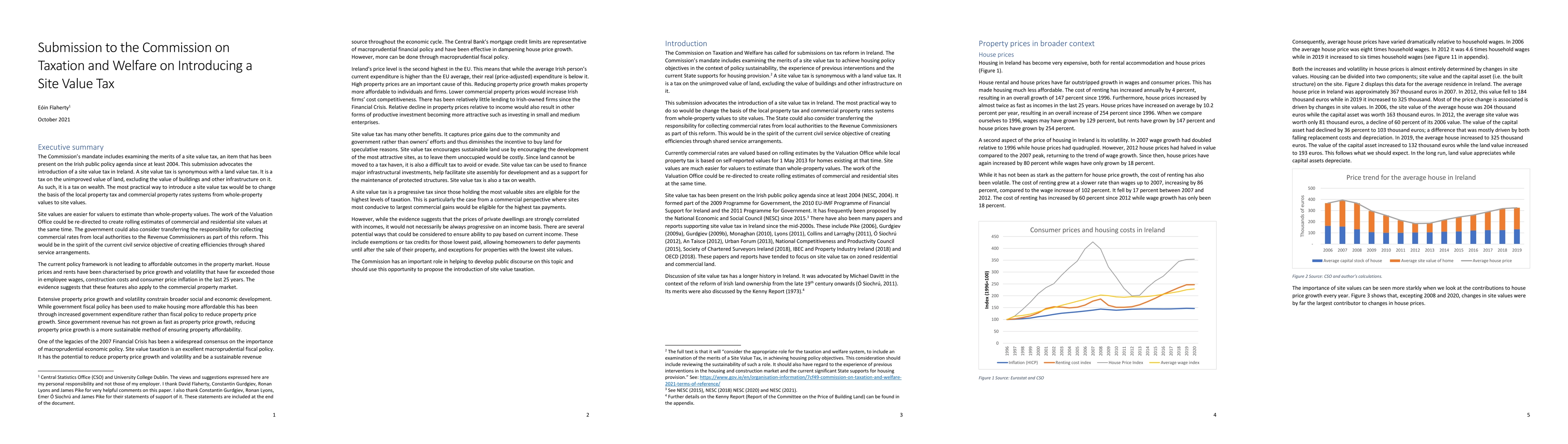

This submission to the Irish Commission on Taxation and Welfare advocates the introduction of a site value tax in Ireland. Ireland has high and volatile property prices, constraining social and economic development. Site values are the main driver of these phenomena. Taxing site values would reduce both the level and volatility of property prices, and thus help to alleviate these problems. Site value tax has many other beneficial features. For example, it captures price gains due to the community and government rather than owners' efforts and thus diminishes the incentive to buy land for speculative reasons. Site value tax can be used to finance infrastructural investments, help facilitate site assembly for development and as a support for the maintenance of protected structures. Site value tax is also a tax on wealth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTaxation Perspectives from Large Language Models: A Case Study on Additional Tax Penalties

Eunkyung Choi, Wonseok Hwang, Young Jin Suh et al.

A network and machine learning approach to detect Value Added Tax fraud

Petros Dellaportas, Sofia C. Olhede, Angelos Alexopoulos et al.

No citations found for this paper.

Comments (0)