Summary

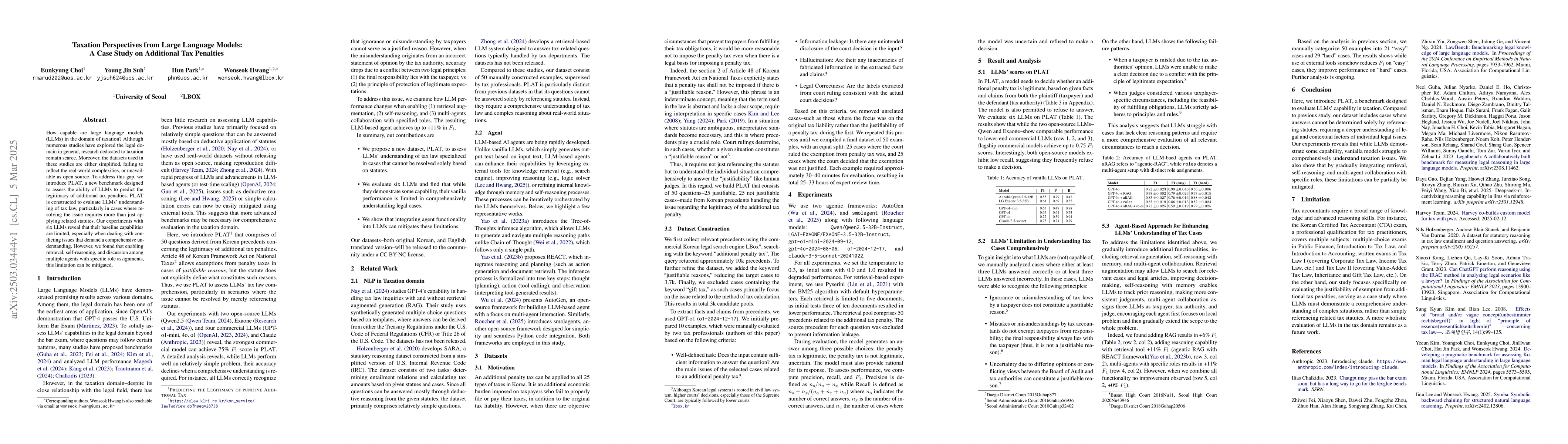

How capable are large language models (LLMs) in the domain of taxation? Although numerous studies have explored the legal domain in general, research dedicated to taxation remain scarce. Moreover, the datasets used in these studies are either simplified, failing to reflect the real-world complexities, or unavailable as open source. To address this gap, we introduce PLAT, a new benchmark designed to assess the ability of LLMs to predict the legitimacy of additional tax penalties. PLAT is constructed to evaluate LLMs' understanding of tax law, particularly in cases where resolving the issue requires more than just applying related statutes. Our experiments with six LLMs reveal that their baseline capabilities are limited, especially when dealing with conflicting issues that demand a comprehensive understanding. However, we found that enabling retrieval, self-reasoning, and discussion among multiple agents with specific role assignments, this limitation can be mitigated.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces PLAT, a benchmark for evaluating large language models (LLMs) in taxation, focusing on predicting the legitimacy of additional tax penalties. The dataset, constructed from Korean legal precedents, consists of 50 questions split into justifiable and non-justifiable cases.

Key Results

- LLMs, including both open-source and commercial models, show limited baseline capabilities in understanding tax cases, particularly those requiring comprehensive evaluation.

- Enabling retrieval, self-reasoning, and multi-agent collaboration with specific role assignments can mitigate these limitations, with F1 scores improving up to 0.75.

- The study highlights the necessity of incorporating external tools, self-reasoning with memory, and multi-agent collaboration for enhancing LLMs' understanding of tax cases.

Significance

This research addresses the scarcity of taxation-specific studies on LLMs and the lack of real-world complexity in existing datasets, providing a valuable benchmark (PLAT) for taxation domain evaluation.

Technical Contribution

PLAT benchmark, an evaluation tool for LLMs in taxation, and the exploration of retrieval augmentation, self-reasoning with memory, and multi-agent collaboration to enhance LLMs' understanding of tax cases.

Novelty

This research is novel in its introduction of PLAT, a taxation-specific benchmark for LLMs, and its examination of various techniques to improve LLMs' comprehension of complex tax cases.

Limitations

- The study focuses specifically on the justifiability of exemption from additional tax penalties, leaving a more comprehensive evaluation of LLMs in the tax domain as future work.

- Tax accountants require a broad range of knowledge and advanced reasoning skills, which current LLMs may not fully embody.

Future Work

- Expanding the scope of LLM evaluation in the tax domain to cover multiple subjects and advanced tax concepts.

- Investigating the integration of more sophisticated legal reasoning methods and broader tax knowledge into LLMs.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLarge Language Models as Tax Attorneys: A Case Study in Legal Capabilities Emergence

Raghav Jain, Jungo Kasai, Meghana Bhat et al.

Submission to the Commission on Taxation and Welfare on introducing a site value tax

Eóin Flaherty, Constantin Gurdgiev, Ronan Lyons et al.

Technical Challenges in Maintaining Tax Prep Software with Large Language Models

Ashutosh Trivedi, Saeid Tizpaz-Niari, Sina Gogani-Khiabani et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)