Summary

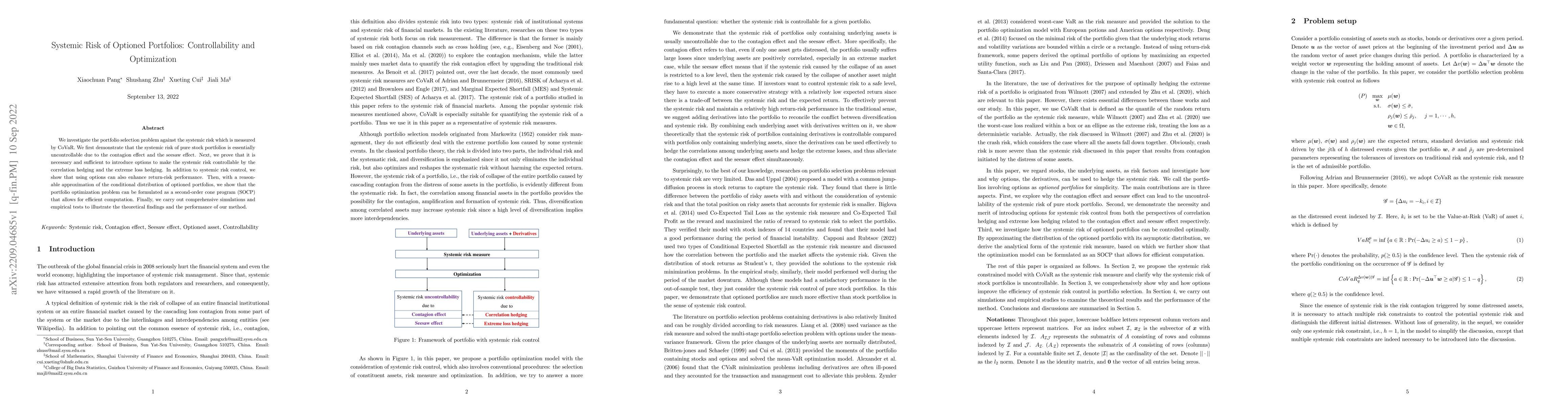

We investigate the portfolio selection problem against the systemic risk which is measured by CoVaR. We first demonstrate that the systemic risk of pure stock portfolios is essentially uncontrollable due to the contagion effect and the seesaw effect. Next, we prove that it is necessary and sufficient to introduce options to make the systemic risk controllable by the correlation hedging and the extreme loss hedging. In addition to systemic risk control, we show that using options can also enhance return-risk performance. Then, with a reasonable approximation of the conditional distribution of optioned portfolios, we show that the portfolio optimization problem can be formulated as a second-order cone program (SOCP) that allows for efficient computation. Finally, we carry out comprehensive simulations and empirical tests to illustrate the theoretical findings and the performance of our method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)