Authors

Summary

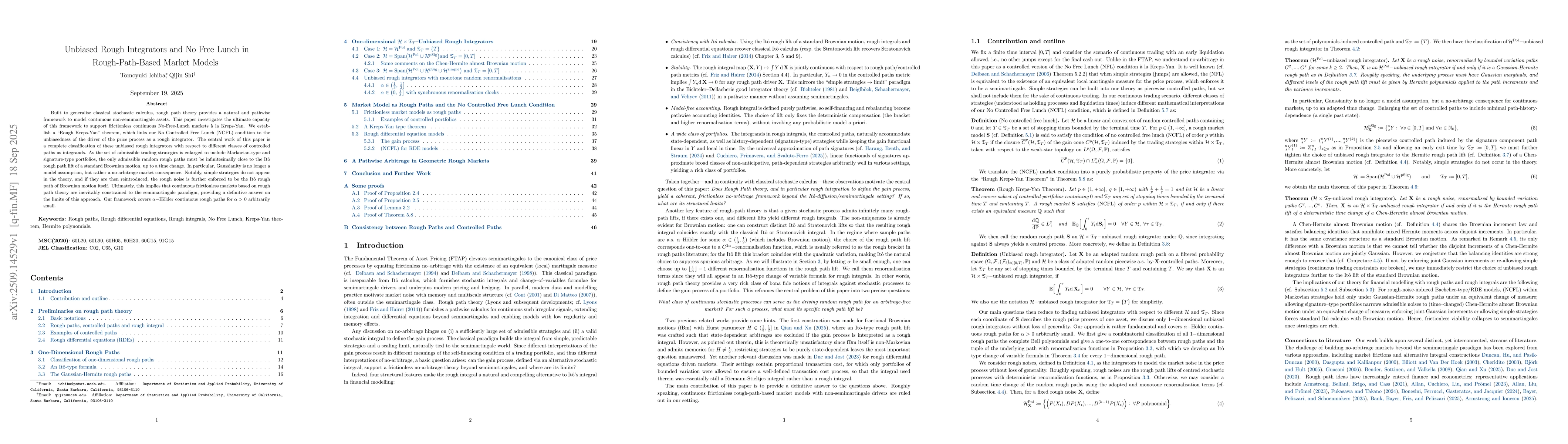

Built to generalise classical stochastic calculus, rough path theory provides a natural and pathwise framework to model continuous non-semimartingale assets. This paper investigates the ultimate capacity of this framework to support frictionless continuous No-Free-Lunch markets \`a la Kreps-Yan. We establish a ``Rough Kreps-Yan" theorem, which links our No Controlled Free Lunch (NCFL) condition to the unbiasedness of the driver of the price process as a rough integrator. The central work of this paper is a complete classification of these unbiased rough integrators with respect to different classes of controlled paths as integrands. As the set of admissible trading strategies is enlarged to include Markovian-type and signature-type portfolios, the only admissible random rough paths must be infinitesimally close to the It\^o rough path lift of a standard Brownian motion, up to a time change. In particular, Gaussianity is no longer a model assumption, but rather a no-arbitrage market consequence. Notably, simple strategies do not appear in the theory, and if they are then reintroduced, the rough noise is further enforced to be the It\^o rough path of Brownian motion itself. Ultimately, this implies that continuous frictionless markets based on rough path theory are inevitably constrained to the semimartingale paradigm, providing a definitive answer on the limits of this approach. Our framework covers $\alpha-$H\"older continuous rough paths for $\alpha>0$ arbitrarily small.

AI Key Findings

Generated Sep 30, 2025

Methodology

The research employs a combination of rough path theory, stochastic calculus, and financial mathematics to analyze market models and arbitrage conditions. It extends classical semimartingale frameworks to more general price processes using controlled paths and rough integrals.

Key Results

- Established a rough path version of the Kreps-Yan theorem for no-arbitrage conditions

- Characterized (NCFL) conditions through existence of unbiased rough integrators under equivalent measures

- Provided universal approximation properties of signature-based portfolios for hedging strategies

Significance

This work bridges financial mathematics and rough path theory, offering new tools for modeling complex market behaviors. It provides a rigorous framework for understanding arbitrage and no-arbitrage conditions in non-semimartingale settings, with implications for risk management and derivative pricing.

Technical Contribution

Formalized the concept of controlled portfolios in rough path settings, established existence criteria for unbiased rough integrators, and provided a rigorous mathematical foundation for signature-based hedging strategies.

Novelty

Introduces a novel framework combining rough path theory with financial mathematics, extending classical no-arbitrage results to non-semimartingale price processes while maintaining mathematical rigor through controlled path approximations.

Limitations

- Focus on theoretical constructs may limit direct applicability to real-world financial markets

- Assumptions about portfolio constraints and market completeness may not fully capture practical trading scenarios

Future Work

- Developing numerical methods for implementing rough path-based financial models

- Extending results to non-Markovian and path-dependent market models

- Investigating robustness of (NCFL) conditions under model uncertainty

Paper Details

PDF Preview

Similar Papers

Found 5 papersModel-free Portfolio Theory: A Rough Path Approach

David J. Prömel, Chong Liu, Christa Cuchiero et al.

Comments (0)