Authors

Summary

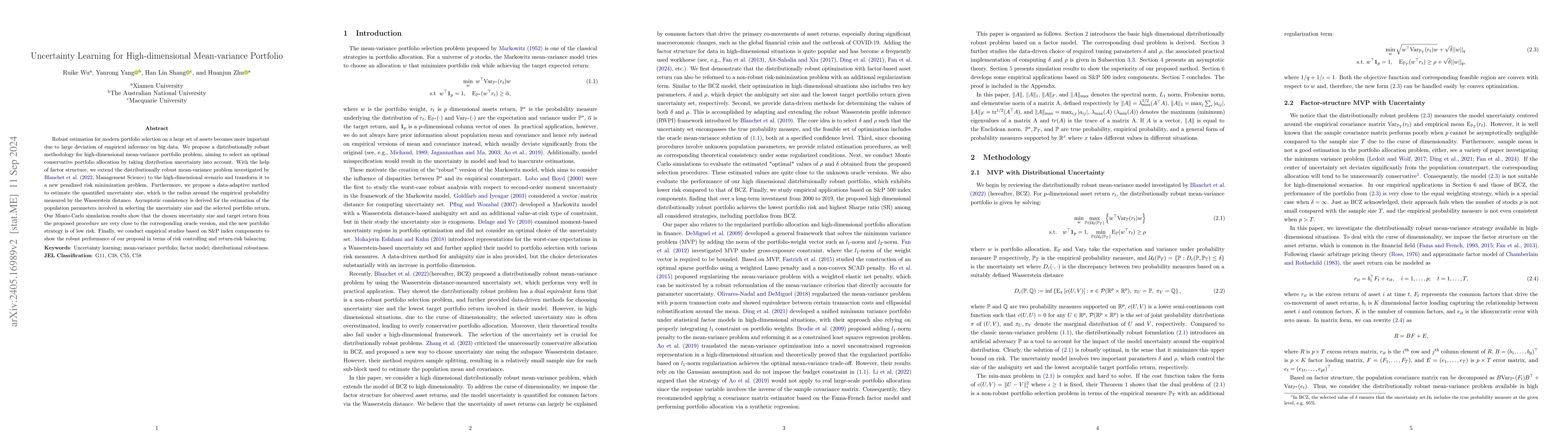

Accounting for uncertainty in Data quality is important for accurate statistical inference. We aim to an optimal conservative allocation for a large universe of assets in mean-variance portfolio (MVP), which is the worst choice within uncertainty in data distribution. Unlike the low dimensional MVP studied in Blanchet et al. (2022, Management Science), the large number of assets raises a challenging problem in quantifying the uncertainty, due to the big deviation of the sample covariance matrix from the population version. To overcome this difficulty, we propose a data-adaptive method to quantify the uncertainty with the help of a factor structure. Monte-Carlo Simulation is conducted to show the superiority of our method in high-dimensional cases, that, avoiding the over-conservative results in Blanchet et al. (2022), our allocation is closer to the oracle version in terms of risk minimization and expected portfolio return controlling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning and Mean-Variance Strategies for Responsible Portfolio Optimization

Manuela Veloso, Fernando Acero, Parisa Zehtabi et al.

Portfolio Optimization Rules beyond the Mean-Variance Approach

Maxime Markov, Vladimir Markov

No citations found for this paper.

Comments (0)