Authors

Summary

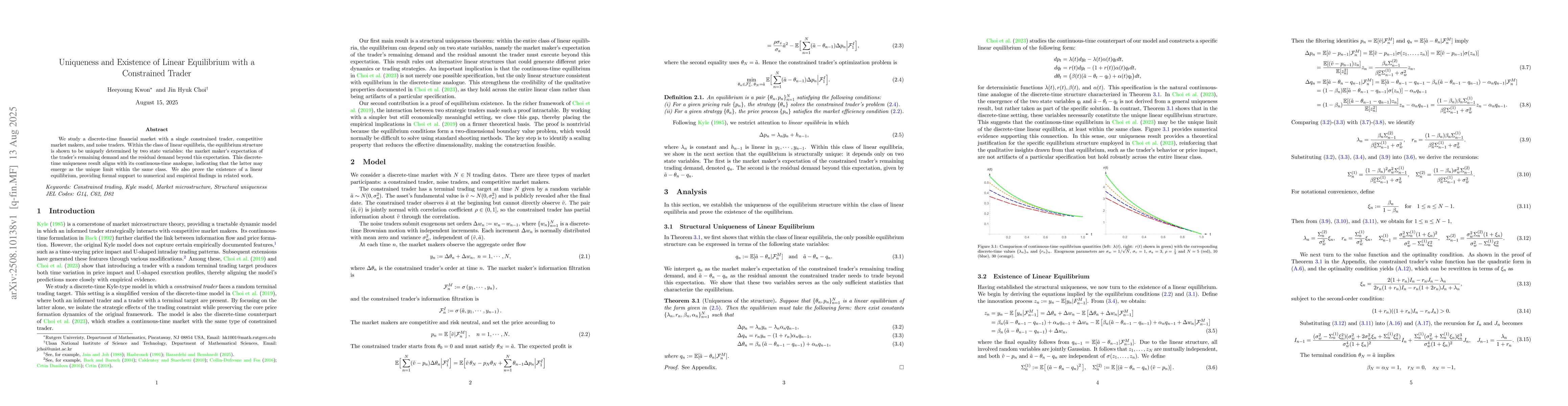

We study a discrete-time financial market with a single constrained trader, competitive market makers, and noise traders. Within the class of linear equilibria, the equilibrium structure is shown to be uniquely determined by two state variables: the market maker's expectation of the trader's remaining demand and the residual demand beyond this expectation. This discrete-time uniqueness result aligns with its continuous-time analogue, indicating that the latter may emerge as the unique limit within the same class. We also prove the existence of a linear equilibrium, providing formal support to numerical and empirical findings in related work.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersLinear constrained Cosserat-shell models including terms up to ${O}(h^5)$. Conditional and unconditional existence and uniqueness

Patrizio Neff, Ionel-Dumitrel Ghiba

Conduct Parameter Estimation in Homogeneous Goods Markets with Equilibrium Existence and Uniqueness Conditions: The Case of Log-linear Specification

Suguru Otani, Yuri Matsumura

Existence and uniqueness of quadratic and linear mean-variance equilibria in general semimartingale markets

Martin Herdegen, Christoph Czichowsky, David Martins

Comments (0)