Summary

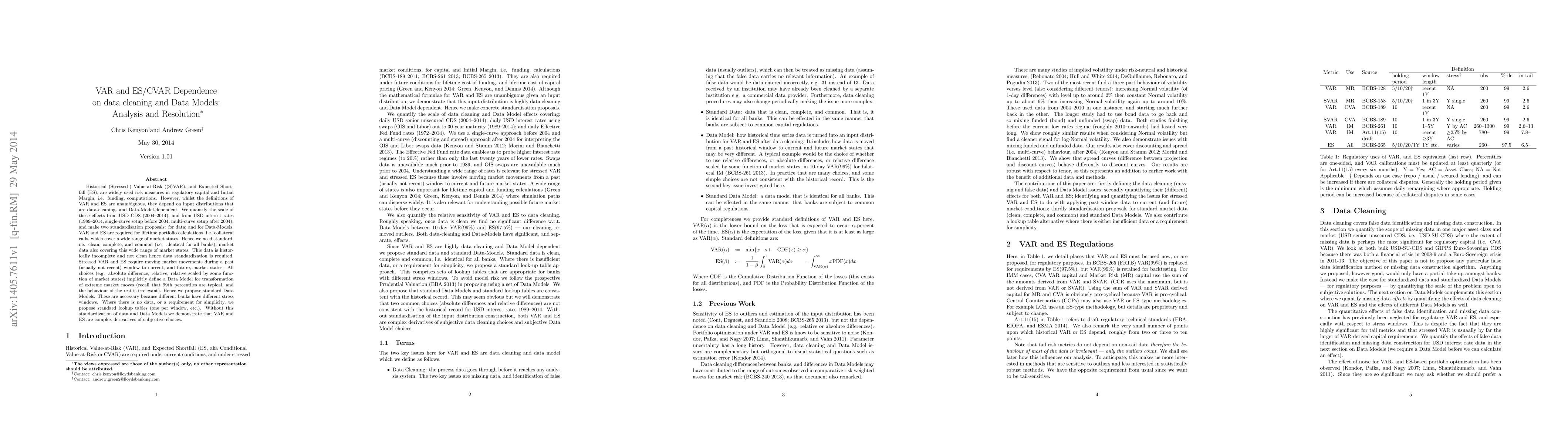

Historical (Stressed-) Value-at-Risk ((S)VAR), and Expected Shortfall (ES), are widely used risk measures in regulatory capital and Initial Margin, i.e. funding, computations. However, whilst the definitions of VAR and ES are unambiguous, they depend on input distributions that are data-cleaning- and Data-Model-dependent. We quantify the scale of these effects from USD CDS (2004--2014), and from USD interest rates (1989--2014, single-curve setup before 2004, multi-curve setup after 2004), and make two standardisation proposals: for data; and for Data-Models. VAR and ES are required for lifetime portfolio calculations, i.e. collateral calls, which cover a wide range of market states. Hence we need standard, i.e. clean, complete, and common (i.e. identical for all banks), market data also covering this wide range of market states. This data is historically incomplete and not clean hence data standardization is required. Stressed VAR and ES require moving market movements during a past (usually not recent) window to current, and future, market states. All choices (e.g. absolute difference, relative, relative scaled by some function of market states) implicitly define a Data Model for transformation of extreme market moves (recall that 99th percentiles are typical, and the behaviour of the rest is irrelevant). Hence we propose standard Data Models. These are necessary because different banks have different stress windows. Where there is no data, or a requirement for simplicity, we propose standard lookup tables (one per window, etc.). Without this standardization of data and Data Models we demonstrate that VAR and ES are complex derivatives of subjective choices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio analysis with mean-CVaR and mean-CVaR-skewness criteria based on mean-variance mixture models

Ruoyu Sun, Kai He, Svetlozar T. Rachev et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)