Summary

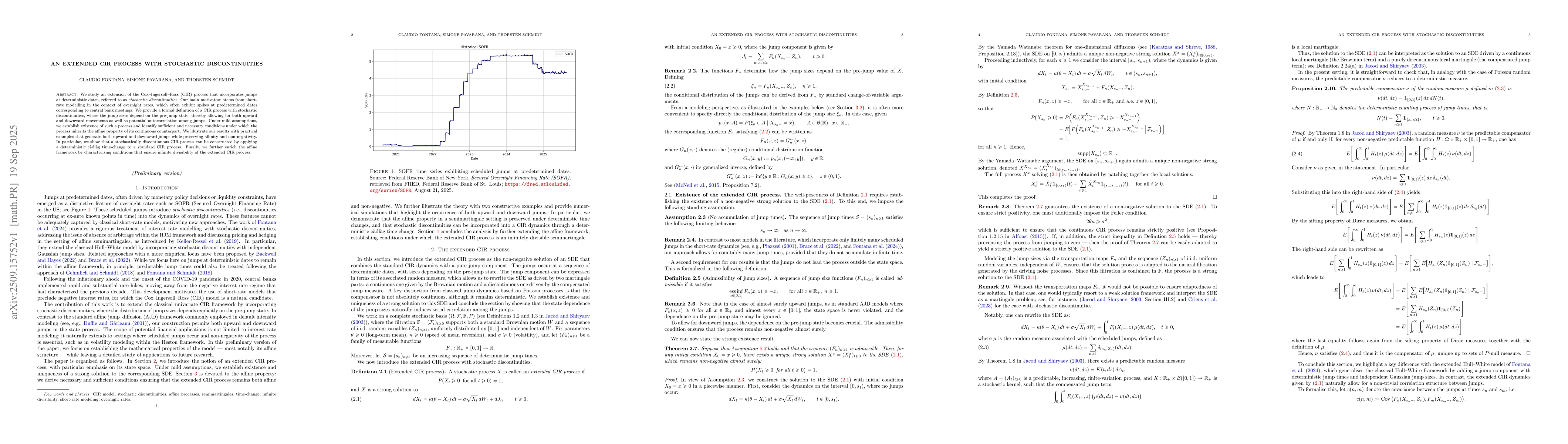

We study an extension of the Cox-Ingersoll-Ross (CIR) process that incorporates jumps at deterministic dates, referred to as stochastic discontinuities. Our main motivation stems from short-rate modelling in the context of overnight rates, which often exhibit jumps at predetermined dates corresponding to central bank meetings. We provide a formal definition of a CIR process with stochastic discontinuities, where the jump sizes depend on the pre-jump state, thereby allowing for both upwarrd and downward movements as well as potential autocorrelation among jumps. Under mild assumptions, we establish existence of such a process and identify sufficient and necessary conditions under which the process inherits the affine property of its continuous counterpart. We illustrate our results with practical examples that generate both upward and downward jumps while preserving the affine property and non-negativity. In particular, we show that a stochastically discontinuous CIR process can be constructed by applying a determinisitic cadlag time-change of a classical CIR process. Finally, we further enrich the affine framework by characterizing conditions that ensure infinite divisibility of the extended CIR process.

AI Key Findings

Generated Sep 30, 2025

Methodology

The research employs a combination of stochastic calculus, affine processes, and martingale methods to analyze the dynamics of interest rate models with discontinuities. It extends existing frameworks by incorporating time-changed CIR models and studying their infinite divisibility properties.

Key Results

- Established existence and uniqueness of quasi-regular, non-negative affine semimartingales solving the CIR SDE with jump components

- Derived conditions for infinite divisibility of jump size distributions in extended CIR models

- Proved that time-changed CIR models preserve infinite divisibility under specified transformations

Significance

This work advances the understanding of discontinuous interest rate models by providing rigorous mathematical foundations for their analysis. The results have implications for risk management, derivative pricing, and modeling of financial markets with jumps.

Technical Contribution

The paper provides a comprehensive framework for analyzing affine processes with jumps, including existence theorems, infinite divisibility conditions, and parameterization of semimartingales with discontinuities.

Novelty

This work introduces a novel approach to modeling discontinuous interest rates by combining time-changing techniques with infinite divisibility properties, offering new insights into the mathematical structure of financial market models.

Limitations

- Focus on specific classes of affine processes may limit broader applicability

- Assumptions about jump size distributions require further empirical validation

Future Work

- Exploring applications to credit risk modeling and collateralized debt obligations

- Investigating connections with stochastic volatility models

- Developing numerical methods for pricing derivatives in these models

Comments (0)