Summary

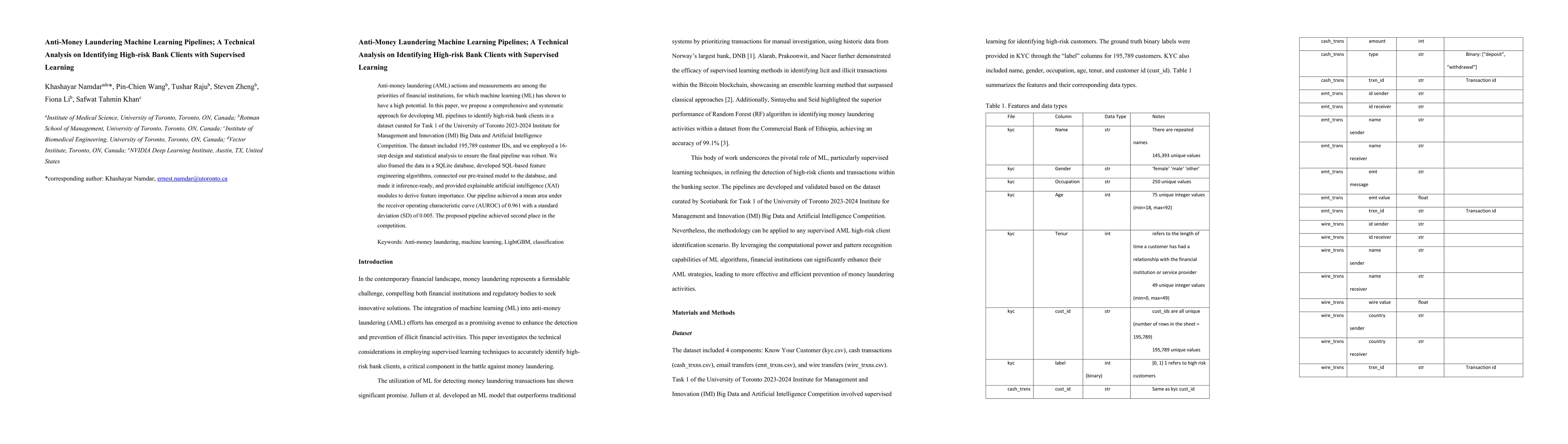

Anti-money laundering (AML) actions and measurements are among the priorities of financial institutions, for which machine learning (ML) has shown to have a high potential. In this paper, we propose a comprehensive and systematic approach for developing ML pipelines to identify high-risk bank clients in a dataset curated for Task 1 of the University of Toronto 2023-2024 Institute for Management and Innovation (IMI) Big Data and Artificial Intelligence Competition. The dataset included 195,789 customer IDs, and we employed a 16-step design and statistical analysis to ensure the final pipeline was robust. We also framed the data in a SQLite database, developed SQL-based feature engineering algorithms, connected our pre-trained model to the database, and made it inference-ready, and provided explainable artificial intelligence (XAI) modules to derive feature importance. Our pipeline achieved a mean area under the receiver operating characteristic curve (AUROC) of 0.961 with a standard deviation (SD) of 0.005. The proposed pipeline achieved second place in the competition.

AI Key Findings

Generated Oct 19, 2025

Methodology

The paper describes a comprehensive approach to developing ML pipelines for AML, including SQL-based feature engineering, XAI modules, and a 16-step design process. It also mentions the use of multiple models, hyperparameter tuning, and cross-validation techniques.

Key Results

- The pipeline achieved an AUROC of 0.961 with a standard deviation of 0.005.

- The proposed pipeline ranked second in the competition.

- Feature importance analysis identified total wire transfers and age as significant predictors.

Significance

This research provides a robust ML pipeline for detecting high-risk clients, which can enhance AML efforts in financial institutions by enabling accurate and efficient risk assessment.

Technical Contribution

The paper contributes a systematic ML pipeline integrating SQL feature engineering, XAI modules, and a robust model selection process with cross-validation and hyperparameter tuning.

Novelty

The novelty lies in the integration of geographical transaction analysis, SQL-based feature engineering, and the use of a comprehensive 16-step design process for AML pipelines.

Limitations

- The pipeline's performance may degrade with changing data patterns over time.

- The use of one-hot encoding increased execution time.

- The study was limited to a specific competition dataset.

Future Work

- Implementing continuous machine learning (CML) for model updates.

- Exploring more advanced models like TabNet or AutoGluon for further performance gains.

- Investigating the impact of real-time data integration on model accuracy.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFighting Money Laundering with Statistics and Machine Learning

Rasmus Jensen, Alexandros Iosifidis

Anti-Money Laundering Alert Optimization Using Machine Learning with Graphs

Ahmad Naser Eddin, Jacopo Bono, David Aparício et al.

LaundroGraph: Self-Supervised Graph Representation Learning for Anti-Money Laundering

Pedro Bizarro, Pedro Saleiro, Mário Cardoso

Catch Me If You Can: Semi-supervised Graph Learning for Spotting Money Laundering

Felix Hermsen, Md. Rezaul Karim, Sisay Adugna Chala et al.

Comments (0)