Authors

Summary

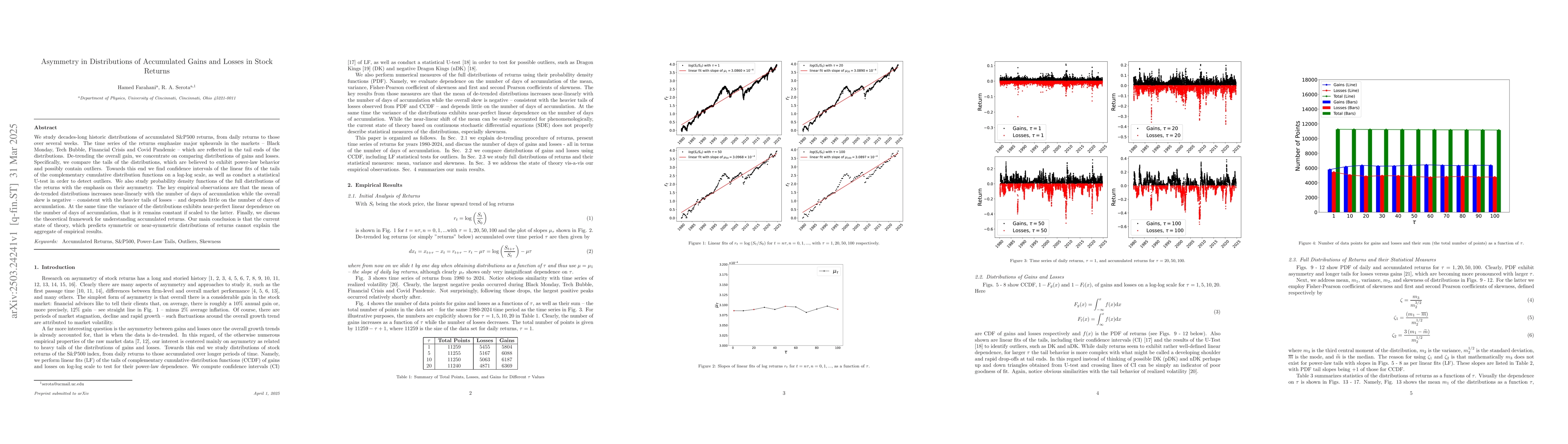

We study decades-long historic distributions of accumulated S\&P500 returns, from daily returns to those over several weeks. The time series of the returns emphasize major upheavals in the markets -- Black Monday, Tech Bubble, Financial Crisis and Covid Pandemic -- which are reflected in the tail ends of the distributions. De-trending the overall gain, we concentrate on comparing distributions of gains and losses. Specifically, we compare the tails of the distributions, which are believed to exhibit power-law behavior and possibly contain outliers. Towards this end we find confidence intervals of the linear fits of the tails of the complementary cumulative distribution functions on a log-log scale, as well as conduct a statistical U-test in order to detect outliers. We also study probability density functions of the full distributions of the returns with the emphasis on their asymmetry. The key empirical observations are that the mean of de-trended distributions increases near-linearly with the number of days of accumulation while the overall skew is negative -- consistent with the heavier tails of losses -- and depends little on the number of days of accumulation. At the same time the variance of the distributions exhibits near-perfect linear dependence on the number of days of accumulation, that is it remains constant if scaled to the latter. Finally, we discuss the theoretical framework for understanding accumulated returns. Our main conclusion is that the current state of theory, which predicts symmetric or near-symmetric distributions of returns cannot explain the aggregate of empirical results.

AI Key Findings

Generated Jun 10, 2025

Methodology

The study examines decades-long historic distributions of accumulated S&P500 returns, analyzing daily to multi-week returns. It focuses on comparing the tails of gain and loss distributions, employing confidence intervals of linear fits on log-log scales and a U-test for outlier detection. The research also investigates the asymmetry of full return probability density functions.

Key Results

- Mean of de-trended distributions increases near-linearly with the number of days of accumulation.

- Overall skew is negative, consistent with heavier tails of losses, and is not significantly affected by the number of days of accumulation.

- Variance of distributions shows near-perfect linear dependence on the number of days, remaining constant when scaled to the latter.

- Current theoretical predictions of symmetric or near-symmetric return distributions cannot explain the empirical findings.

Significance

This research is crucial for understanding stock market behavior and can inform investment strategies by revealing the asymmetry in gains and losses over time, challenging existing theoretical frameworks.

Technical Contribution

The paper presents a comprehensive analysis of the asymmetry in stock return distributions, employing statistical methods to characterize tail behavior and outlier detection.

Novelty

The research distinguishes itself by demonstrating that existing theoretical models fail to explain the empirical results, highlighting the asymmetry in gains and losses over time in stock market returns.

Limitations

- The study is limited to S&P500 returns and does not explore other markets or asset classes.

- Findings are based on historical data and may not generalize to future market conditions.

Future Work

- Investigate whether the observed patterns hold for other stock indices and asset classes.

- Explore the applicability of these findings under various market scenarios and economic conditions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersPredicting the distributions of stock returns around the globe in the era of big data and learning

Jozef Barunik, Martin Hronec, Ondrej Tobek

No citations found for this paper.

Comments (0)