Summary

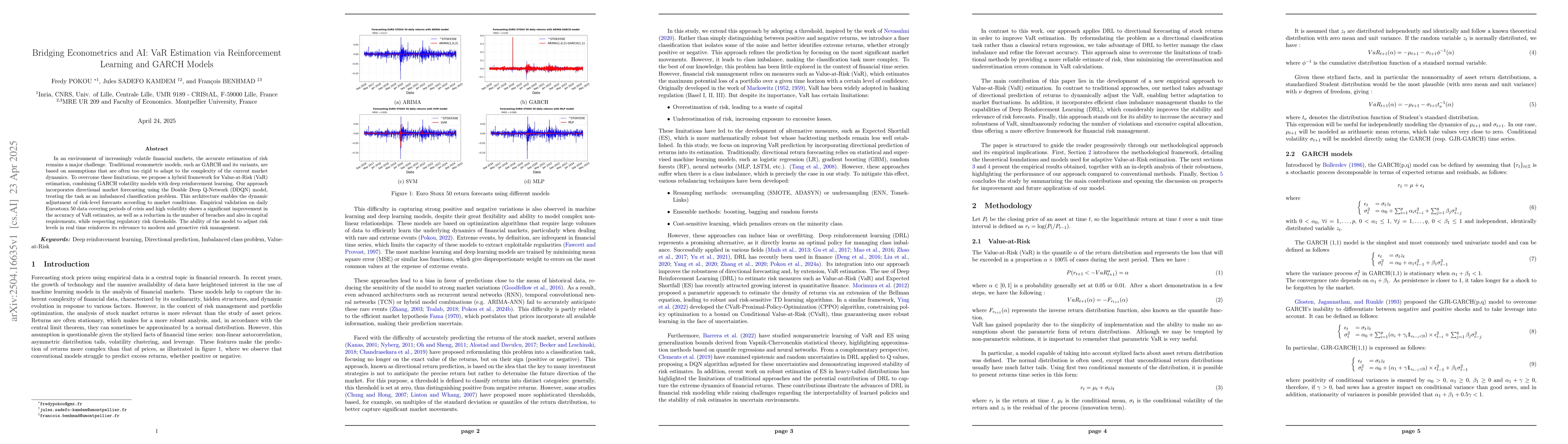

In an environment of increasingly volatile financial markets, the accurate estimation of risk remains a major challenge. Traditional econometric models, such as GARCH and its variants, are based on assumptions that are often too rigid to adapt to the complexity of the current market dynamics. To overcome these limitations, we propose a hybrid framework for Value-at-Risk (VaR) estimation, combining GARCH volatility models with deep reinforcement learning. Our approach incorporates directional market forecasting using the Double Deep Q-Network (DDQN) model, treating the task as an imbalanced classification problem. This architecture enables the dynamic adjustment of risk-level forecasts according to market conditions. Empirical validation on daily Eurostoxx 50 data covering periods of crisis and high volatility shows a significant improvement in the accuracy of VaR estimates, as well as a reduction in the number of breaches and also in capital requirements, while respecting regulatory risk thresholds. The ability of the model to adjust risk levels in real time reinforces its relevance to modern and proactive risk management.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research proposes a hybrid framework for Value-at-Risk (VaR) estimation, combining GARCH volatility models with deep reinforcement learning, specifically using the Double Deep Q-Network (DDQN) for directional market forecasting.

Key Results

- The proposed model significantly improves the accuracy of VaR estimates.

- The model reduces the number of VaR breaches and capital requirements while respecting regulatory risk thresholds.

- Empirical validation on Eurostoxx 50 data shows the model's real-time adjustment capability for dynamic risk-level forecasts.

- The Reinforcement Learning (RL) model outperforms traditional models and Temporal Convolutional Network (TCN) in VaR estimation, especially in periods of high market volatility.

- The RL model demonstrates superior performance in meeting regulatory tests like Kupiec and Christoffersen tests.

Significance

This research is important as it addresses the limitations of traditional econometric models in adapting to complex market dynamics, providing a more accurate and proactive risk management solution for financial institutions.

Technical Contribution

The paper introduces a novel hybrid framework that combines GARCH models with reinforcement learning (DDQN) for more accurate and adaptive VaR estimation.

Novelty

This work stands out by bridging econometrics and AI, offering a dynamic and more responsive approach to VaR estimation that adapts to changing market conditions, unlike traditional static models.

Limitations

- The model's performance is contingent on the quality and representativeness of the chosen explanatory variables.

- Implementation requires a relatively long calibration phase and advanced algorithmic expertise.

Future Work

- Explore the application of this hybrid framework to other financial markets and asset classes.

- Investigate the integration of additional machine learning techniques to further enhance VaR estimation.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCombining Deep Learning and GARCH Models for Financial Volatility and Risk Forecasting

Łukasz Kwiatkowski, Jakub Michańków, Janusz Morajda

Variational Inference for GARCH-family Models

Martin Magris, Alexandros Iosifidis

Can AI Master Econometrics? Evidence from Econometrics AI Agent on Expert-Level Tasks

Qiang Chen, Yuxiao Wu, Jin Li et al.

No citations found for this paper.

Comments (0)