Summary

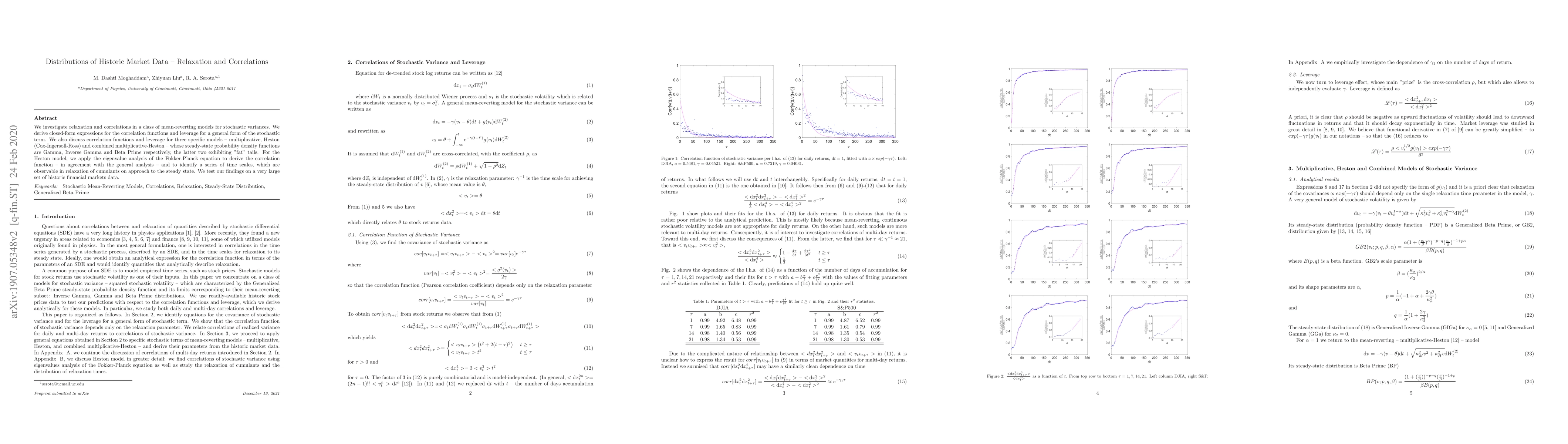

We investigate relaxation and correlations in a class of mean-reverting models for stochastic variances. We derive closed-form expressions for the correlation functions and leverage for a general form of the stochastic term. We also discuss correlation functions and leverage for three specific models -- multiplicative, Heston (Cox-Ingersoll-Ross) and combined multiplicative-Heston -- whose steady-state probability density functions are Gamma, Inverse Gamma and Beta Prime respectively, the latter two exhibiting "fat" tails. For the Heston model, we apply the eigenvalue analysis of the Fokker-Planck equation to derive the correlation function -- in agreement with the general analysis -- and to identify a series of time scales, which are observable in relaxation of cumulants on approach to the steady state. We test our findings on a very large set of historic financial markets data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)