Summary

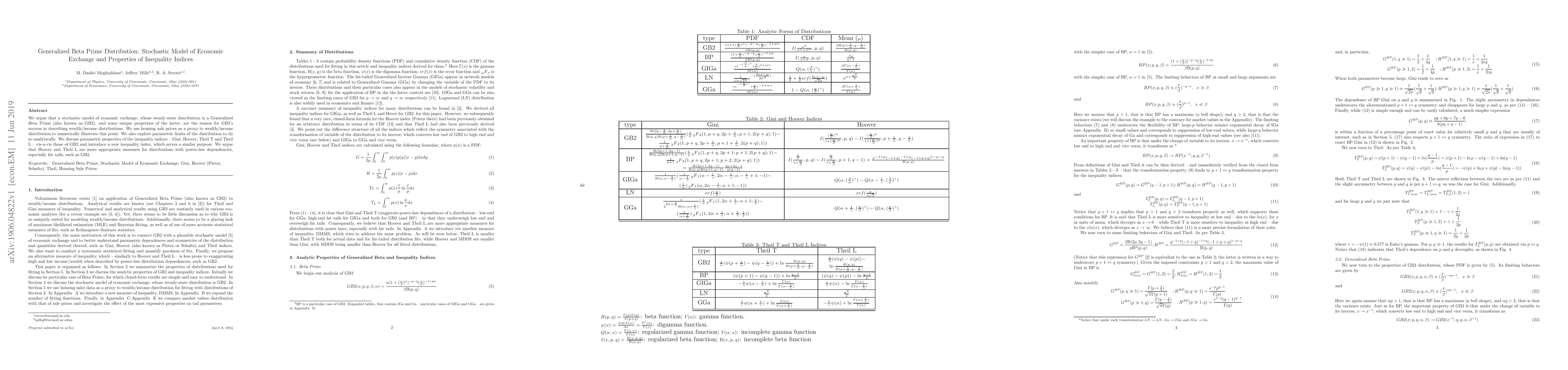

We argue that a stochastic model of economic exchange, whose steady-state distribution is a Generalized Beta Prime (also known as GB2), and some unique properties of the latter, are the reason for GB2's success in describing wealth/income distributions. We use housing sale prices as a proxy to wealth/income distribution to numerically illustrate this point. We also explore parametric limits of the distribution to do so analytically. We discuss parametric properties of the inequality indices -- Gini, Hoover, Theil T and Theil L -- vis-a-vis those of GB2 and introduce a new inequality index, which serves a similar purpose. We argue that Hoover and Theil L are more appropriate measures for distributions with power-law dependencies, especially fat tails, such as GB2.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKinetic Exchange Income Distribution Models with Saving Propensities: Inequality Indices and Self-Organised Poverty Level

Sudip Mukherjee, Bikas K. Chakrabarti, Asim Ghosh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)