Summary

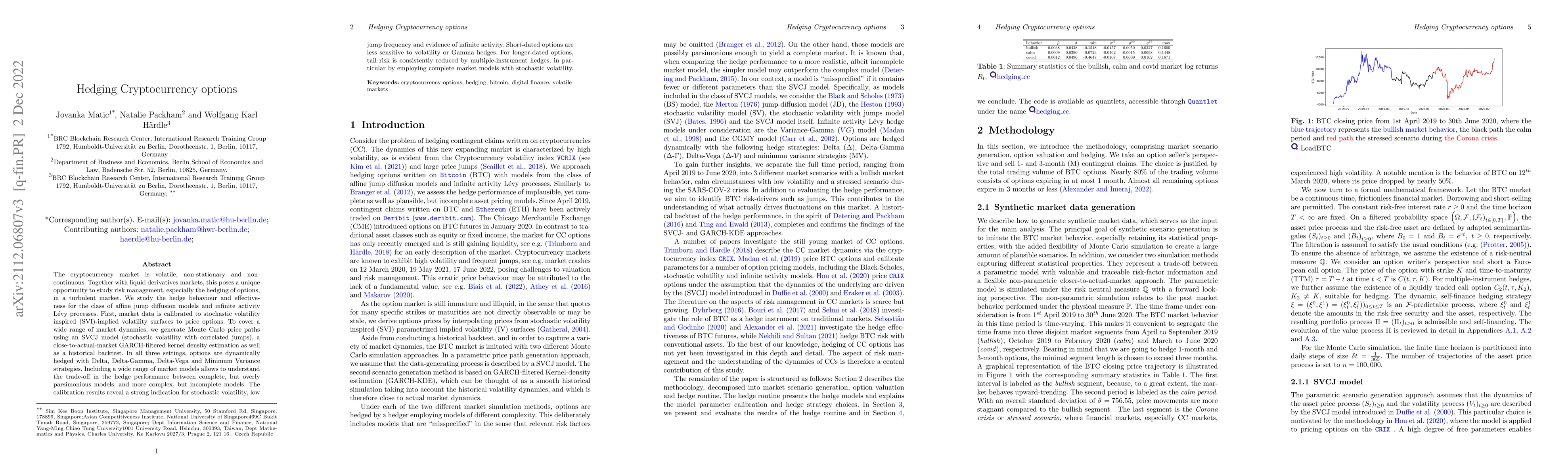

The cryptocurrency market is volatile, non-stationary and non-continuous. Together with liquid derivatives markets, this poses a unique opportunity to study risk management, especially the hedging of options, in a turbulent market. We study the hedge behaviour and effectiveness for the class of affine jump diffusion models and infinite activity Levy processes. First, market data is calibrated to stochastic volatility inspired (SVI)-implied volatility surfaces to price options. To cover a wide range of market dynamics, we generate Monte Carlo price paths using an SVCJ model (stochastic volatility with correlated jumps), a close-to-actual-market GARCH-filtered kernel density estimation as well as a historical backtest. In all three settings, options are dynamically hedged with Delta, Delta-Gamma, Delta-Vega and Minimum Variance strategies. Including a wide range of market models allows to understand the trade-off in the hedge performance between complete, but overly parsimonious models, and more complex, but incomplete models. The calibration results reveal a strong indication for stochastic volatility, low jump frequency and evidence of infinite activity. Short-dated options are less sensitive to volatility or Gamma hedges. For longer-dated options, tail risk is consistently reduced by multiple-instrument hedges, in particular by employing complete market models with stochastic volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)