Summary

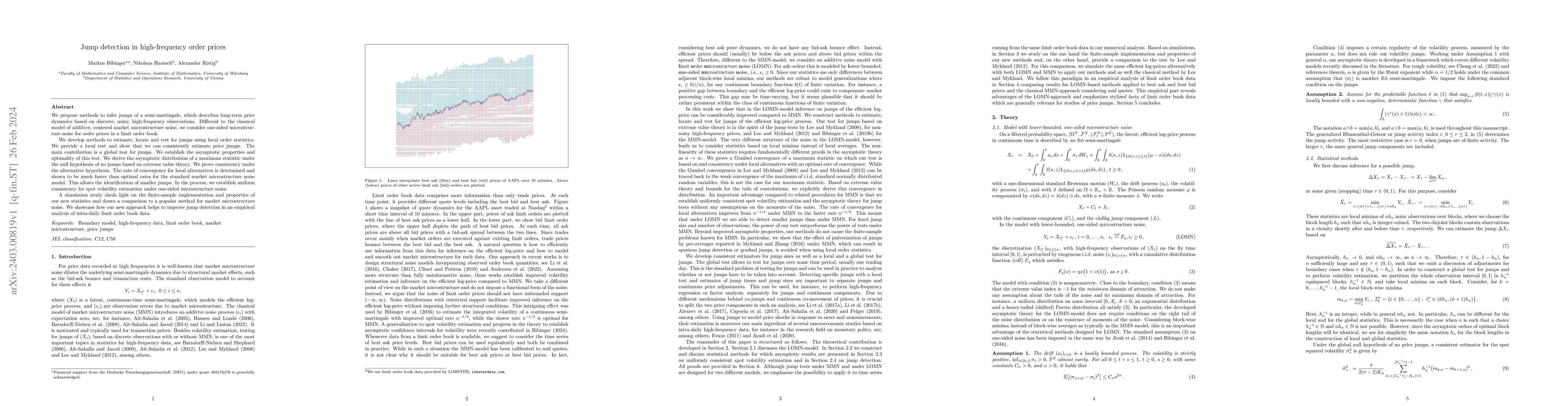

We propose methods to infer jumps of a semi-martingale, which describes long-term price dynamics based on discrete, noisy, high-frequency observations. Different to the classical model of additive, centered market microstructure noise, we consider one-sided microstructure noise for order prices in a limit order book. We develop methods to estimate, locate and test for jumps using local order statistics. We provide a local test and show that we can consistently estimate price jumps. The main contribution is a global test for jumps. We establish the asymptotic properties and optimality of this test. We derive the asymptotic distribution of a maximum statistic under the null hypothesis of no jumps based on extreme value theory. We prove consistency under the alternative hypothesis. The rate of convergence for local alternatives is determined and shown to be much faster than optimal rates for the standard market microstructure noise model. This allows the identification of smaller jumps. In the process, we establish uniform consistency for spot volatility estimation under one-sided microstructure noise. A simulation study sheds light on the finite-sample implementation and properties of our new statistics and draws a comparison to a popular method for market microstructure noise. We showcase how our new approach helps to improve jump detection in an empirical analysis of intra-daily limit order book data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling Price Clustering in High-Frequency Prices

Vladimír Holý, Petra Tomanová

| Title | Authors | Year | Actions |

|---|

Comments (0)