Summary

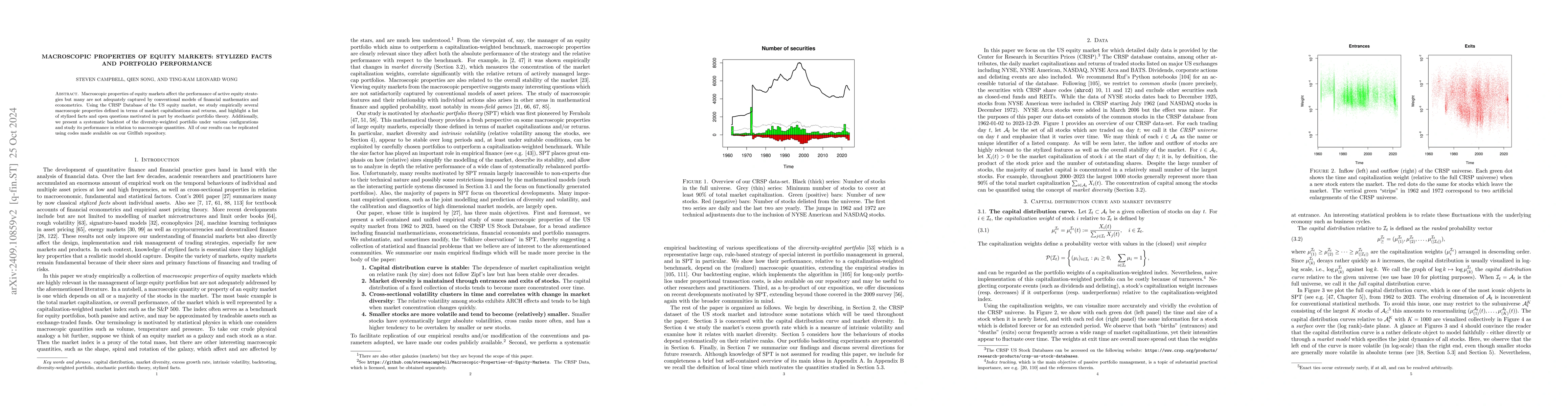

Macroscopic properties of equity markets affect the performance of active equity strategies but many are not adequately captured by conventional models of financial mathematics and econometrics. Using the CRSP Database of the US equity market, we study empirically several macroscopic properties defined in terms of market capitalizations and returns, and highlight a list of stylized facts and open questions motivated in part by stochastic portfolio theory. Additionally, we present a systematic backtest of the diversity-weighted portfolio under various configurations and study its performance in relation to macroscopic quantities. All of our results can be replicated using codes made available on our GitHub repository.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersRevisiting Cont's Stylized Facts for Modern Stock Markets

Ethan Ratliff-Crain, Colin M. Van Oort, James Bagrow et al.

International Financial Markets Through 150 Years: Evaluating Stylized Facts

Maximilian Janisch, Thomas Lehéricy, Sara A. Safari

No citations found for this paper.

Comments (0)