Summary

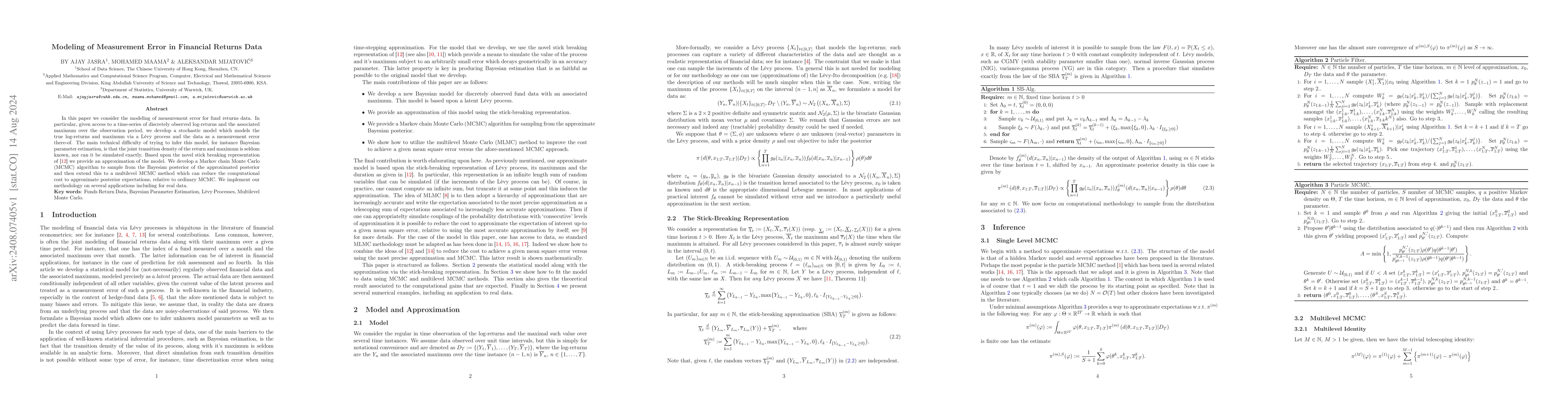

In this paper we consider the modeling of measurement error for fund returns data. In particular, given access to a time-series of discretely observed log-returns and the associated maximum over the observation period, we develop a stochastic model which models the true log-returns and maximum via a L\'evy process and the data as a measurement error there-of. The main technical difficulty of trying to infer this model, for instance Bayesian parameter estimation, is that the joint transition density of the return and maximum is seldom known, nor can it be simulated exactly. Based upon the novel stick breaking representation of [12] we provide an approximation of the model. We develop a Markov chain Monte Carlo (MCMC) algorithm to sample from the Bayesian posterior of the approximated posterior and then extend this to a multilevel MCMC method which can reduce the computational cost to approximate posterior expectations, relative to ordinary MCMC. We implement our methodology on several applications including for real data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling and Simulation of Financial Returns under Non-Gaussian Distributions

Giacomo Livan, Federica De Domenico, Guido Montagna et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)