Summary

We investigate the use of the normalized imbalance between option volumes corresponding to positive and negative market views, as a predictor for directional price movements in the spot market. Via a nonlinear analysis, and using a decomposition of aggregated volumes into five distinct market participant classes, we find strong signs of predictability of excess market overnight returns. The strongest signals come from Market-Maker volumes. Among other findings, we demonstrate that most of the predictability stems from high-implied-volatility option contracts, and that the informational content of put option volumes is greater than that of call options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

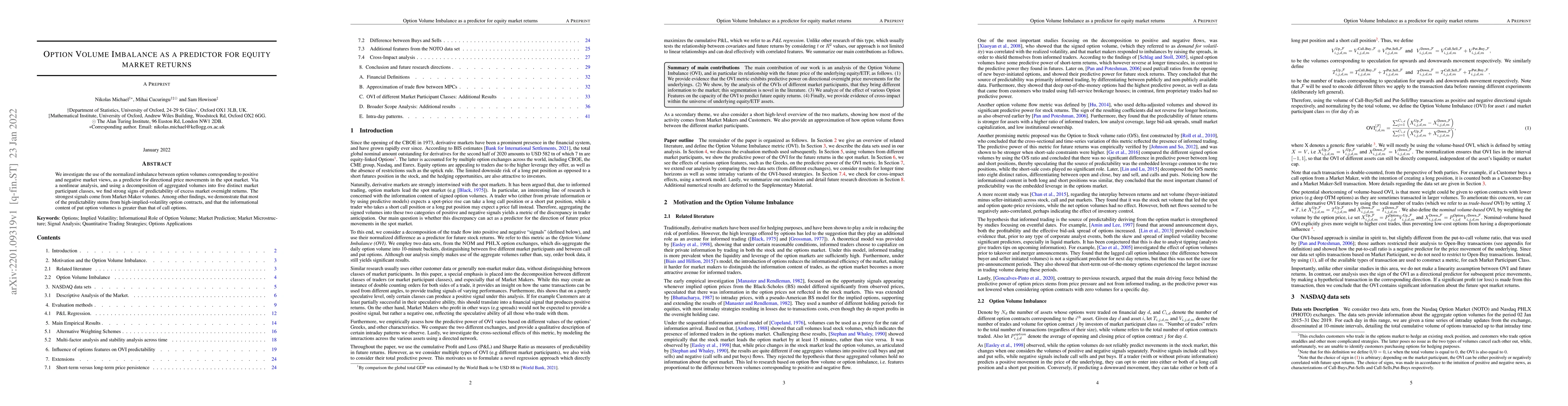

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)