Summary

We propose two novel frameworks to study the price formation of an asset negotiated in an order book. Specifically, we develop a game-theoretic model in many-person games and mean-field games, considering costs stemming from limited liquidity. We derive analytical formulas for the formed price in terms of the realized order flow. We also identify appropriate conditions that ensure the convergence of the price we find in the finite population game to that of its mean-field counterpart. We numerically assess our results with a large experiment using high-frequency data from ten stocks listed in the NASDAQ, a stock listed in B3 in Brazil, and a cryptocurrency listed in Binance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

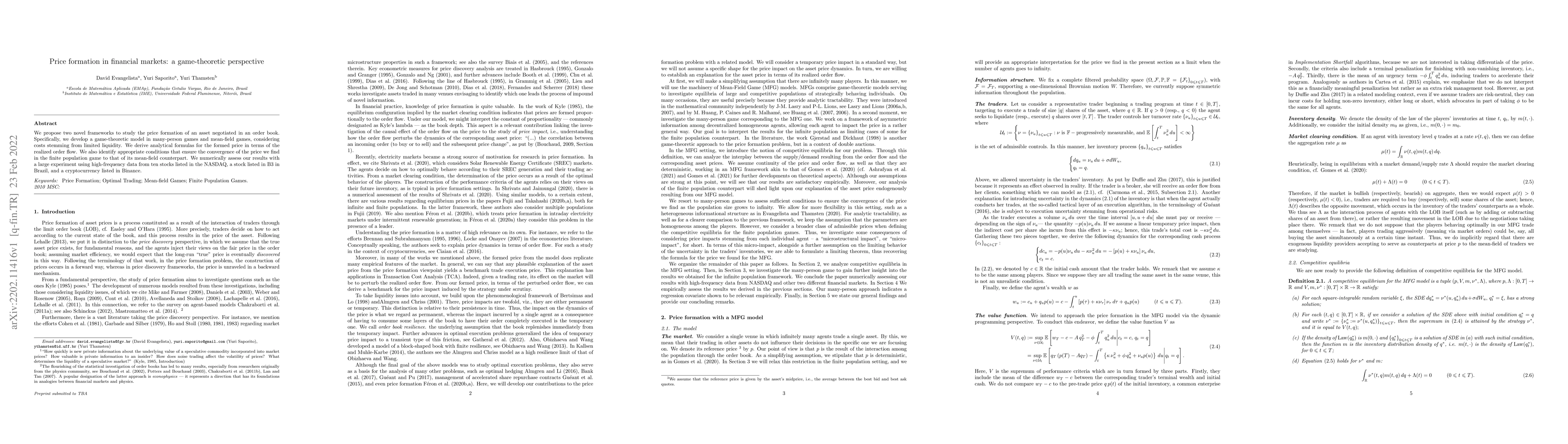

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)