Summary

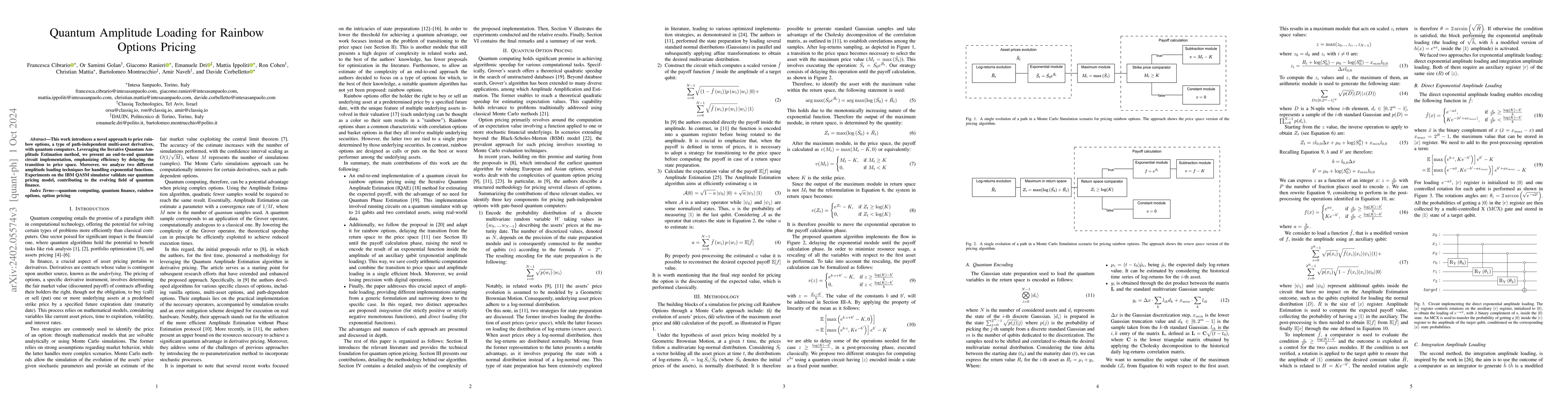

This work introduces a novel approach to price rainbow options, a type of path-independent multi-asset derivatives, with quantum computers. Leveraging the Iterative Quantum Amplitude Estimation method, we present an end-to-end quantum circuit implementation, emphasizing efficiency by delaying the transition to price space. Moreover, we analyze two different amplitude loading techniques for handling exponential functions. Experiments on the IBM QASM simulator validate our quantum pricing model, contributing to the evolving field of quantum finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutocallable Options Pricing with Integration-Based Exponential Amplitude Loading

Tamuz Danzig, Christian Mattia, Giacomo Ranieri et al.

No citations found for this paper.

Comments (0)