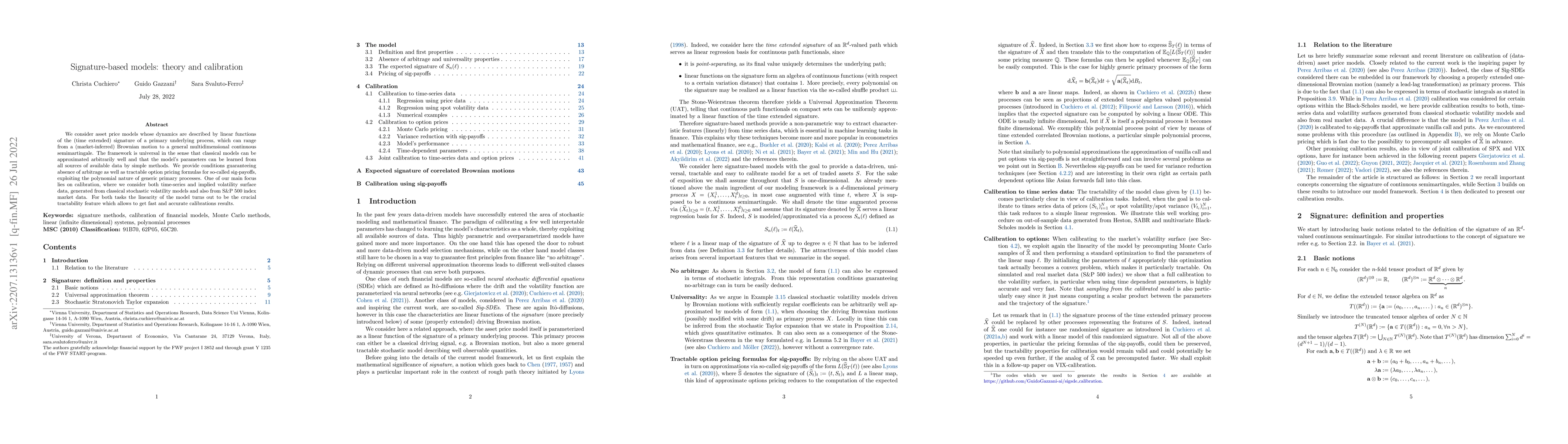

Summary

We consider asset price models whose dynamics are described by linear functions of the (time extended) signature of a primary underlying process, which can range from a (market-inferred) Brownian motion to a general multidimensional continuous semimartingale. The framework is universal in the sense that classical models can be approximated arbitrarily well and that the model's parameters can be learned from all sources of available data by simple methods. We provide conditions guaranteeing absence of arbitrage as well as tractable option pricing formulas for so-called sig-payoffs, exploiting the polynomial nature of generic primary processes. One of our main focus lies on calibration, where we consider both time-series and implied volatility surface data, generated from classical stochastic volatility models and also from S&P500 index market data. For both tasks the linearity of the model turns out to be the crucial tractability feature which allows to get fast and accurate calibrations results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersJoint calibration to SPX and VIX options with signature-based models

Guido Gazzani, Christa Cuchiero, Sara Svaluto-Ferro et al.

Volatility Modeling with Rough Paths: A Signature-Based Alternative to Classical Expansions

Rafael de Santiago, Elisa Alòs, Josep Vives et al.

Bayesian Calibration for Activity Based Models

Vadim Sokolov, Joshua Auld, Laura Schultz

Pointcheval-Sanders Signature-Based Synchronized Aggregate Signature

Masayuki Tezuka, Keisuke Tanaka

| Title | Authors | Year | Actions |

|---|

Comments (0)