Summary

This article reveals a specific category of solutions for the $1+1$ Variable Order (VO) nonlinear fractional Fokker-Planck equations. These solutions are formulated using VO $q$-Gaussian functions, granting them significant versatility in their application to various real-world systems, such as financial economy areas spanning from conventional stock markets to cryptocurrencies. The VO $q$-Gaussian functions provide a more robust expression for the distribution function of price returns in real-world systems. Additionally, we analyzed the temporal evolution of the anomalous characteristic exponents derived from our study, which are associated with the long-range memory in time series data and autocorrelation patterns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

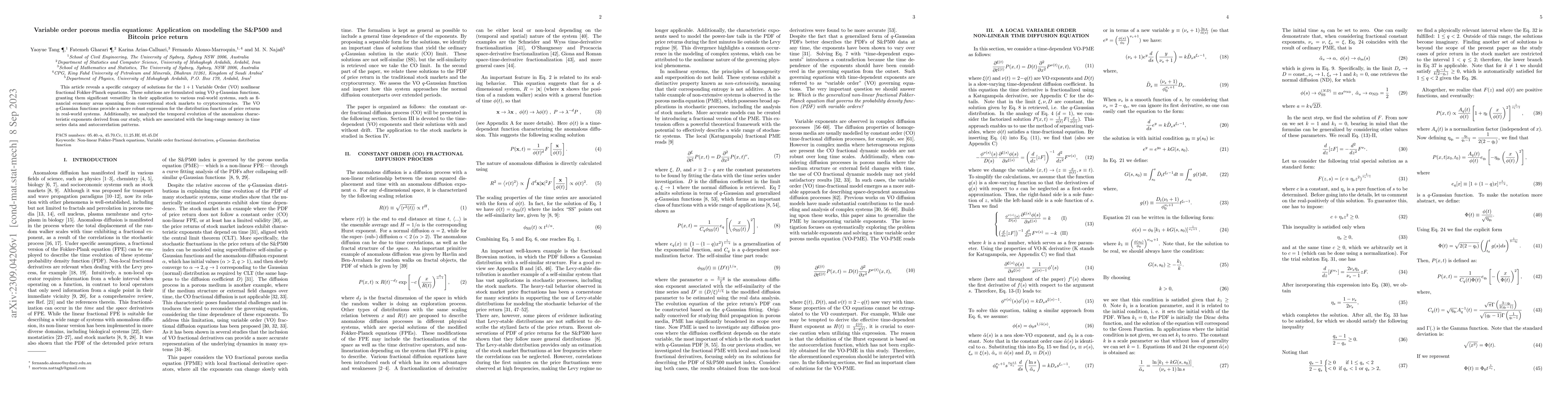

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparative analysis of stationarity for Bitcoin and the S&P500

Yaoyue Tang, Karina Arias-Calluari, Michael S. Harré

| Title | Authors | Year | Actions |

|---|

Comments (0)