Summary

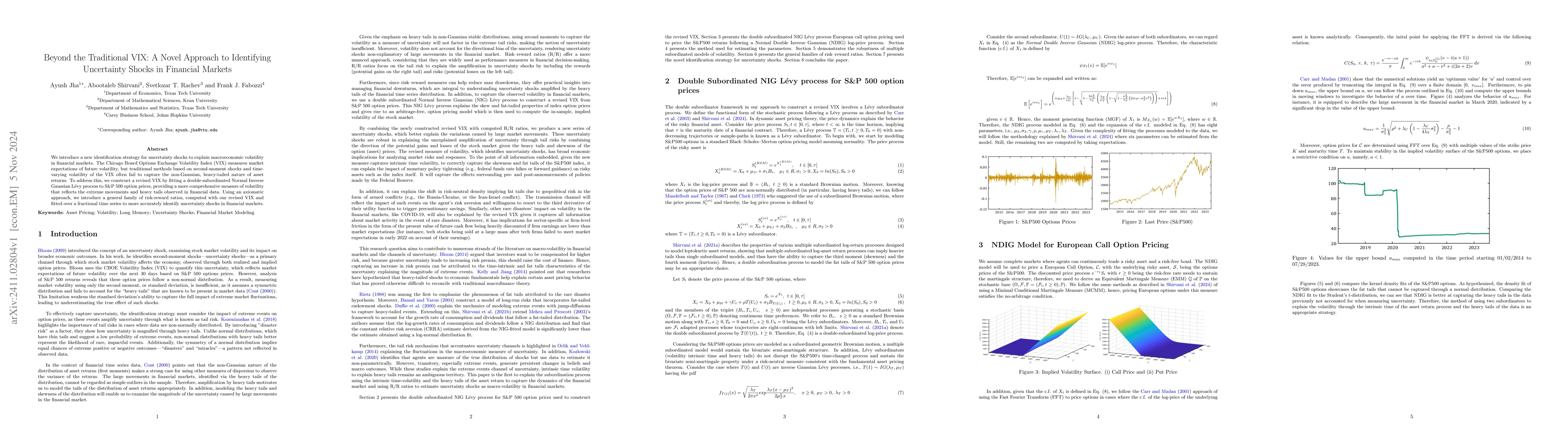

We introduce a new identification strategy for uncertainty shocks to explain macroeconomic volatility in financial markets. The Chicago Board Options Exchange Volatility Index (VIX) measures market expectations of future volatility, but traditional methods based on second-moment shocks and time-varying volatility of the VIX often fail to capture the non-Gaussian, heavy-tailed nature of asset returns. To address this, we construct a revised VIX by fitting a double-subordinated Normal Inverse Gaussian Levy process to S&P 500 option prices, providing a more comprehensive measure of volatility that reflects the extreme movements and heavy tails observed in financial data. Using an axiomatic approach, we introduce a general family of risk-reward ratios, computed with our revised VIX and fitted over a fractional time series to more accurately identify uncertainty shocks in financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)