Authors

Summary

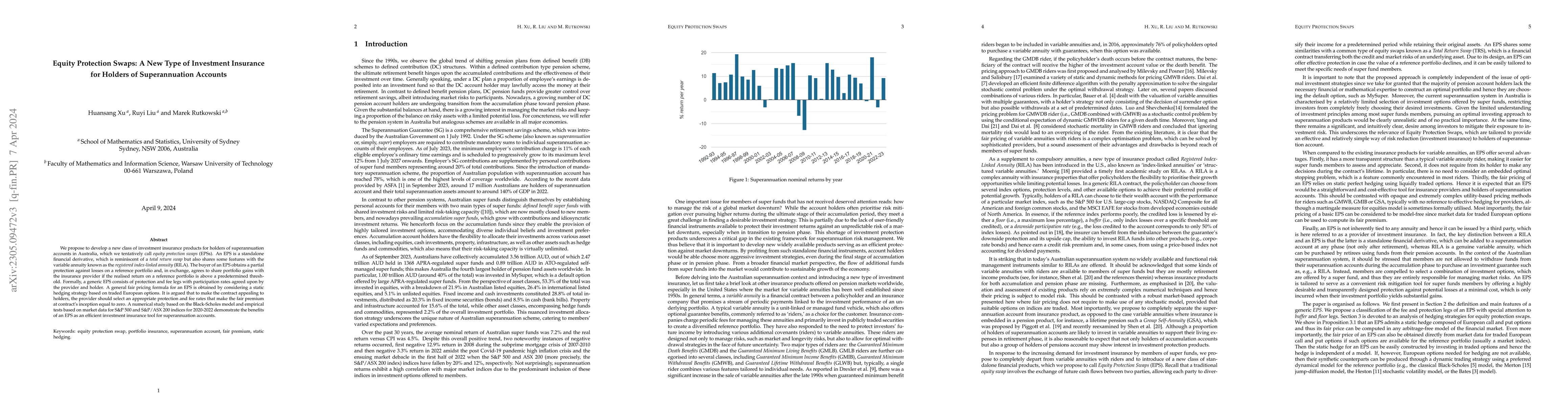

We propose to develop a new class of investment insurance products for holders of superannuation accounts in Australia, which we tentatively call equity protection swaps (EPSs). An EPS is a standalone financial derivative, which is reminiscent of a total return swap but also shares some features with the variable annuity known as the registered index-linked annuity (RILA). The buyer of an EPS obtains partial protection against losses on a reference portfolio and, in exchange, agrees to share portfolio gains with the insurance provider if the realized return on a reference portfolio is above a predetermined threshold. Formally, a generic EPS consists of protection and fee legs with participation rates agreed upon by the provider and holder. A general fair pricing formula for an EPS is obtained by considering a static hedging strategy based on traded European options. It is argued that to make the contract appealing to holders, the provider should select appropriate protection and fee rates that make the fair premium at the contract's inception equal to zero. A numerical study based on the Black-Scholes model and empirical tests based on market data for S\&P~500 and S&P/ASX~200 indices for 2020-2022 demonstrates the benefits of an EPS as an efficient investment insurance tool for superannuation accounts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing and Hedging Strategies for Cross-Currency Equity Protection Swaps

Huansang Xu, Marek Rutkowski

Optimal Investment in Equity and Credit Default Swaps in the Presence of Default

Zhe Fei, Scott Robertson

| Title | Authors | Year | Actions |

|---|

Comments (0)