Summary

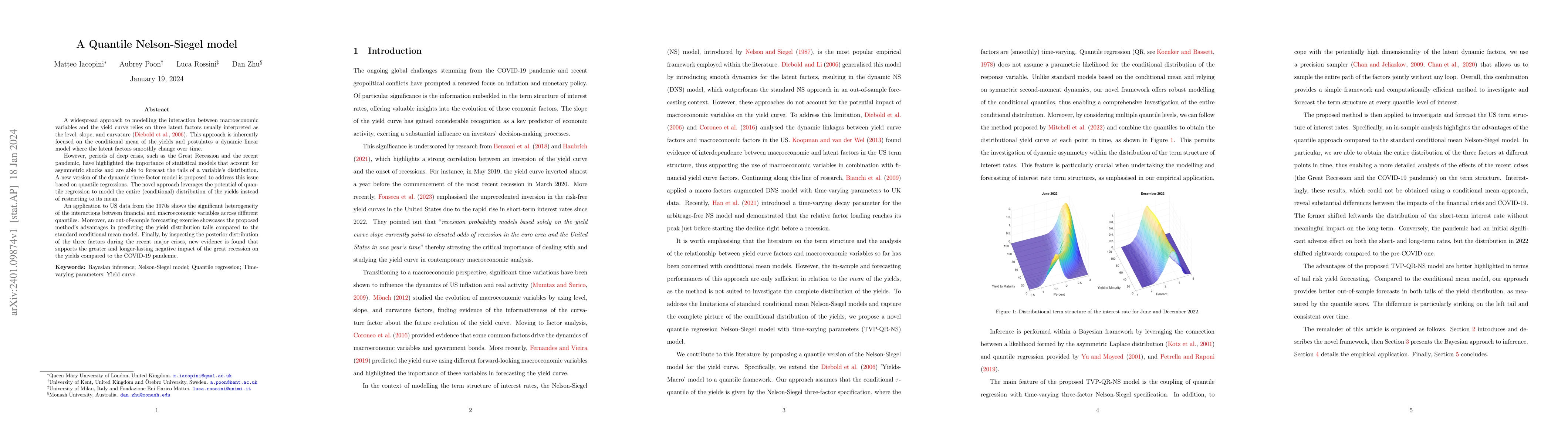

A widespread approach to modelling the interaction between macroeconomic variables and the yield curve relies on three latent factors usually interpreted as the level, slope, and curvature (Diebold et al., 2006). This approach is inherently focused on the conditional mean of the yields and postulates a dynamic linear model where the latent factors smoothly change over time. However, periods of deep crisis, such as the Great Recession and the recent pandemic, have highlighted the importance of statistical models that account for asymmetric shocks and are able to forecast the tails of a variable's distribution. A new version of the dynamic three-factor model is proposed to address this issue based on quantile regressions. The novel approach leverages the potential of quantile regression to model the entire (conditional) distribution of the yields instead of restricting to its mean. An application to US data from the 1970s shows the significant heterogeneity of the interactions between financial and macroeconomic variables across different quantiles. Moreover, an out-of-sample forecasting exercise showcases the proposed method's advantages in predicting the yield distribution tails compared to the standard conditional mean model. Finally, by inspecting the posterior distribution of the three factors during the recent major crises, new evidence is found that supports the greater and longer-lasting negative impact of the great recession on the yields compared to the COVID-19 pandemic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInestability presented in the estimating of the Nelson-Siegel-Svensson model

Ainara Rodríguez-Sánchez

No citations found for this paper.

Comments (0)