Summary

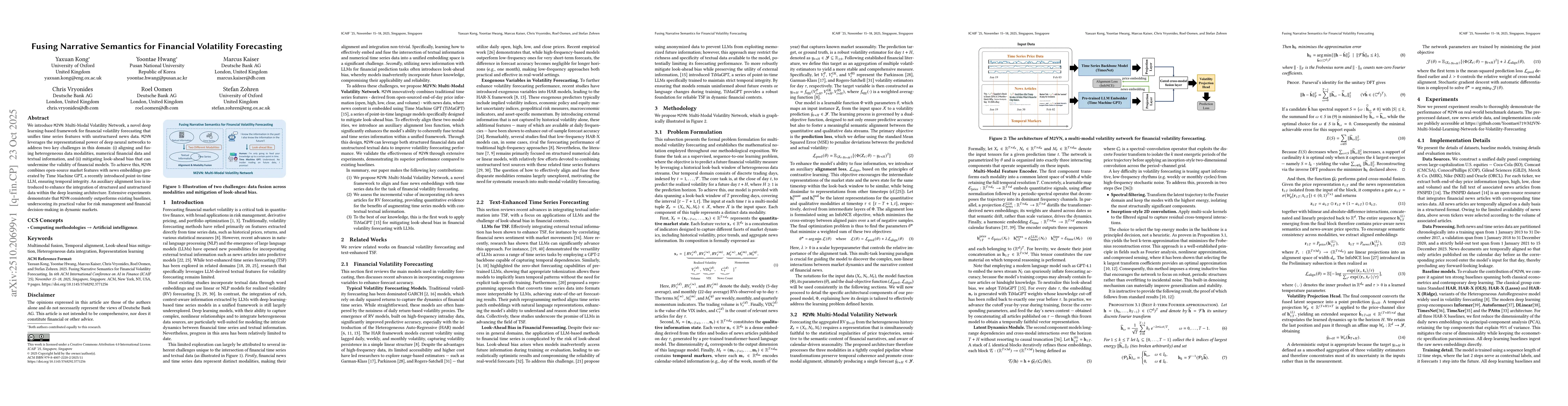

We introduce M2VN: Multi-Modal Volatility Network, a novel deep learning-based framework for financial volatility forecasting that unifies time series features with unstructured news data. M2VN leverages the representational power of deep neural networks to address two key challenges in this domain: (i) aligning and fusing heterogeneous data modalities, numerical financial data and textual information, and (ii) mitigating look-ahead bias that can undermine the validity of financial models. To achieve this, M2VN combines open-source market features with news embeddings generated by Time Machine GPT, a recently introduced point-in-time LLM, ensuring temporal integrity. An auxiliary alignment loss is introduced to enhance the integration of structured and unstructured data within the deep learning architecture. Extensive experiments demonstrate that M2VN consistently outperforms existing baselines, underscoring its practical value for risk management and financial decision-making in dynamic markets.

AI Key Findings

Generated Oct 24, 2025

Methodology

The study introduces M2VN, a deep learning framework that integrates structured financial time series with unstructured news narratives using temporally faithful news embeddings from TiMaGPT and cross-modal alignment via a contrastive loss.

Key Results

- M2VN outperforms both classical econometric models and deep learning baselines in volatility forecasting

- Trading volume and news embeddings provide unique complementary predictive signals

- The model effectively captures extreme volatility shocks and improves forecast accuracy for rare events

Significance

This research advances financial forecasting by combining structured data with narrative insights, enhancing risk management and market analysis capabilities.

Technical Contribution

Development of M2VN framework with cross-modal integration and look-ahead bias mitigation techniques

Novelty

First to combine temporally faithful news embeddings with cross-modal alignment for volatility forecasting in a multi-modal architecture

Limitations

- The model's performance may vary across different market conditions

- Dependence on high-quality news embeddings and historical price data

Future Work

- Exploring sector-specific news impacts and company-specific event frequencies

- Investigating the role of information efficiency in stock volatility dynamics

Paper Details

PDF Preview

Similar Papers

Found 4 papersIntegrated GARCH-GRU in Financial Volatility Forecasting

Zhenyu Cui, Steve Yang, Jingyi Wei

Realised Volatility Forecasting: Machine Learning via Financial Word Embedding

Stefan Zohren, Eghbal Rahimikia, Ser-Huang Poon

An adaptive volatility method for probabilistic forecasting and its application to the M6 financial forecasting competition

Nicklas Werge, Joseph de Vilmarest

Comments (0)